Container shipping rate China to Australia and New Zealand price November 2024 and outlook (see chart below)

- Global:US$1439.88/Container, 1% up

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, fitness for purpose or timeliness.

Container shipping rate China to Australia and New Zealand

This post is a summary of the Container shipping rate China to Australia and New Zealand price developments. The price developments of Container freight China to Australia and New Zealand are expressed in US$ prices converted FX rates applicable at the time when the price was valid. Container freight China to Australia and New Zealand price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Container shipping price for China to Australia and New Zealand is generated from different inputs including:

- Market futures for Container shipping rates for China to Australia and New Zealand

- Longer term trends in likely demand conditions

Further sources of information on the Container shipping rates China to Australia and New Zealand price chart

What are container shipping freight rates

Container freight shipping rates can vary widely depending on several factors. These rates are typically determined by the shipping industry and can fluctuate due to changes in supply and demand, fuel prices, shipping routes, container availability, and other market conditions. Here are some key factors that influence container freight shipping rates:

Container Size and Type

The size and type of container you use will affect the shipping rate. Standard container sizes include 20-foot and 40-foot containers, but there are also specialized containers like refrigerated containers (reefers) and high cube containers.

Shipping Route

The distance and complexity of the shipping route play a significant role in determining rates. Longer routes and those that require transshipment or multiple carriers can be more expensive.

Cargo Weight and Volume

The weight and volume of your cargo will impact the rate. Heavier and bulkier cargo may incur higher charges.

Cargo Type

The type of cargo you’re shipping can also affect the rate. Hazardous or sensitive goods may require special handling and therefore cost more to ship.

Fuel Prices

Fluctuations in fuel prices can have a direct impact on shipping costs, as fuel is a significant expense for shipping companies.

Seasonal Demand

Shipping rates can vary throughout the year due to seasonal factors. For example, rates may be higher during peak shipping seasons like the holiday season.

Carrier and Shipping Line

Different shipping companies and carriers may offer different rates for the same route and cargo. The choice of carrier can affect the overall cost.

Market Conditions

Global economic conditions, supply and demand for shipping services, and other market factors can cause shipping rates to change.

Contract vs. Spot Rates

Some businesses negotiate long-term contracts with shipping lines, which can provide more stability in rates. Others rely on spot rates, which can fluctuate based on market conditions.

Additional Charges

There may be additional charges, such as port fees, customs duties, insurance, and handling fees, which can add to the overall shipping cost.

To obtain specific container freight shipping rates for your cargo and route, it’s best to contact shipping companies or freight forwarders directly. They can provide you with accurate and up-to-date pricing based on your unique requirements. Additionally, online shipping rate calculators and freight marketplaces can help you estimate shipping costs for your cargo. Keep in mind that these rates can change frequently, so it’s essential to stay informed about current market conditions when planning your shipments.

What is the container shipping route China to Australia and New Zealand

The container shipping route from China to Australia and New Zealand is a major maritime trade route in the Asia-Pacific region. Several shipping lines and routes are available for cargo transport between these countries. The specific route and shipping line you choose may depend on factors such as the port of origin and destination, transit times, and cost considerations.

Here is a general overview of the routes and major ports commonly used for container shipping between China, Australia, and New Zealand:

China to Australia

Ports in China

Major ports like Shanghai, Ningbo, and Shenzhen are often used for shipments to Australia.

Ports in Australia

Ports in Australia, such as Sydney, Melbourne, Brisbane, and Fremantle, are common destinations.

Shipping Lines

Various shipping lines, including Maersk, CMA CGM, Mediterranean Shipping Company (MSC), and others, operate on this route.

China to New Zealand:

Ports in China

Ports in China, including Shanghai and Ningbo, are often used for cargo heading to New Zealand.

Ports in New Zealand

Ports like Auckland, Tauranga, Wellington, and Christchurch are major destinations.

Shipping Lines

Shipping companies such as Maersk, ANL, Hamburg Süd, and others offer services on this route.

Shipping schedules and routes may vary, so it’s advisable to check with specific shipping lines and logistics providers for the most up-to-date information on routes, transit times, and rates. The choice of route and shipping line may also depend on the type of cargo and specific requirements you have for your shipment

What are the major seafreight routes

Seafreight routes, also known as maritime shipping routes or shipping lanes, are the established paths that ships follow when transporting goods and cargo across the world’s oceans and seas. These routes are determined by various factors, including geography, trade patterns, and safety considerations. Some of the major seafreight routes in the world include:

Transpacific Route

This route connects ports in Asia, primarily China, Japan, South Korea, and Southeast Asia, with ports on the west coast of North America, such as Los Angeles, Long Beach, and Vancouver. It is one of the busiest seafreight routes due to the significant trade between Asia and North America.

Transatlantic Route

This route connects ports in North America, including those on the east coast of the United States and Canada, with ports in Europe, particularly those in the United Kingdom, northern Europe, and the Mediterranean. It is a vital trade route for goods moving between North America and Europe.

Suez Canal Route

The Suez Canal in Egypt is a crucial maritime passage that connects the Mediterranean Sea with the Red Sea. It allows ships to avoid the lengthy and treacherous journey around the southern tip of Africa, significantly reducing travel time between Europe and Asia.

Panama Canal Route

The Panama Canal connects the Atlantic Ocean with the Pacific Ocean, allowing ships to pass through Central America instead of traveling around the southern tip of South America. It is vital for trade between the east coast of the United States and the west coast of South America and Asia.

Indian Ocean Route

This route connects ports in the Middle East, India, Southeast Asia, and East Africa. It is a major route for the transportation of goods between Europe, Asia, and Africa.

North-South Route

This route runs along the west coast of Africa and connects northern European ports with ports in West Africa and South Africa. It facilitates trade between Europe and Africa.

Australia/New Zealand Route

This route connects ports in Australia and New Zealand with those in Asia, North America, and Europe. It is vital for the transportation of goods to and from Oceania.

Arctic Route

With the melting of Arctic ice due to climate change, there has been increased interest in using the Northern Sea Route, also known as the Northeast Passage. This route crosses the Arctic Ocean and connects Asia with Europe, significantly reducing travel distances, but it is subject to ice conditions and seasonal limitations.

Intra-Asia Routes

Within Asia, there are numerous routes connecting ports in various countries, such as China, Japan, South Korea, Taiwan, Vietnam, and Indonesia. These routes support regional trade and are important for the distribution of goods within Asia.

These major seafreight routes are the backbone of global trade, facilitating the movement of goods and raw materials between continents and contributing to the global economy. The choice of route for a particular shipment depends on factors such as the origin and destination of the cargo, transit time requirements, cost considerations, and the type of cargo being transported.

Wwhat drives the price of container shipping

The price of container shipping is influenced by several factors, both short-term and long-term. These factors can cause fluctuations in shipping rates and impact the overall cost of transporting goods in containers. Some of the key drivers of container shipping prices include:

Global Supply and Demand

Supply and demand dynamics in the shipping industry play a significant role in determining container shipping rates. When demand for container space is high (e.g., during peak shipping seasons or when global trade is robust), shipping rates tend to increase. Conversely, when demand is low, rates may decrease.

Container Availability

The availability of shipping containers can impact prices. Container shortages can occur when containers are stranded at certain ports, not returned promptly, or when demand exceeds supply. Container shortages can drive up leasing costs, which can be passed on to shippers.

Fuel Costs

Fuel costs, especially the price of marine bunker fuel (typically heavy fuel oil or low-sulfur fuel oil), have a direct impact on shipping rates. Fluctuations in oil prices can lead to variations in fuel surcharges imposed by shipping companies.

Vessel Capacity and Utilization

The size and capacity of container vessels, as well as their utilization rates, affect shipping rates. Larger vessels can carry more containers, but they also require more cargo to be economically viable. High utilization rates can help reduce per-container shipping costs.

Operating Costs

Shipping companies have various operational costs, including crew salaries, maintenance, port fees, insurance, and administrative expenses. These costs can influence pricing decisions.

Trade Imbalances

The balance of trade between regions can impact shipping rates. Routes with a surplus of containers (e.g., exports exceeding imports) may have lower rates due to the need to reposition empty containers.

Regulations and Environmental Standards

Environmental regulations, such as those related to emissions and fuel quality (e.g., the International Maritime Organization’s sulfur regulations), can affect shipping costs. Compliance with these regulations may necessitate investments in cleaner technologies or the use of more expensive low-sulfur fuels.

Weather and Geopolitical Events

Adverse weather conditions, natural disasters, geopolitical tensions, and disruptions such as strikes or port congestion can disrupt shipping schedules and affect prices.

Currency Exchange Rates

Fluctuations in currency exchange rates can impact the cost of shipping, especially for international trade. Exchange rate movements can affect the cost of leasing containers, fuel costs, and other expenses.

Market Consolidation

The shipping industry has seen significant consolidation in recent years, with larger shipping alliances and fewer major players. Market dynamics within these alliances can influence pricing strategies and rates.

Infrastructure Investments

Investments in port infrastructure, container handling facilities, and transportation networks can impact the efficiency and cost-effectiveness of container shipping.

It’s important to note that container shipping rates are often negotiated between shipping companies and shippers on a contractual basis. These rates can vary based on the terms of the contract, the volume of cargo being shipped, and other factors specific to the shipping agreement. As a result, pricing in the container shipping industry can be complex and dynamic, with multiple factors at play.

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

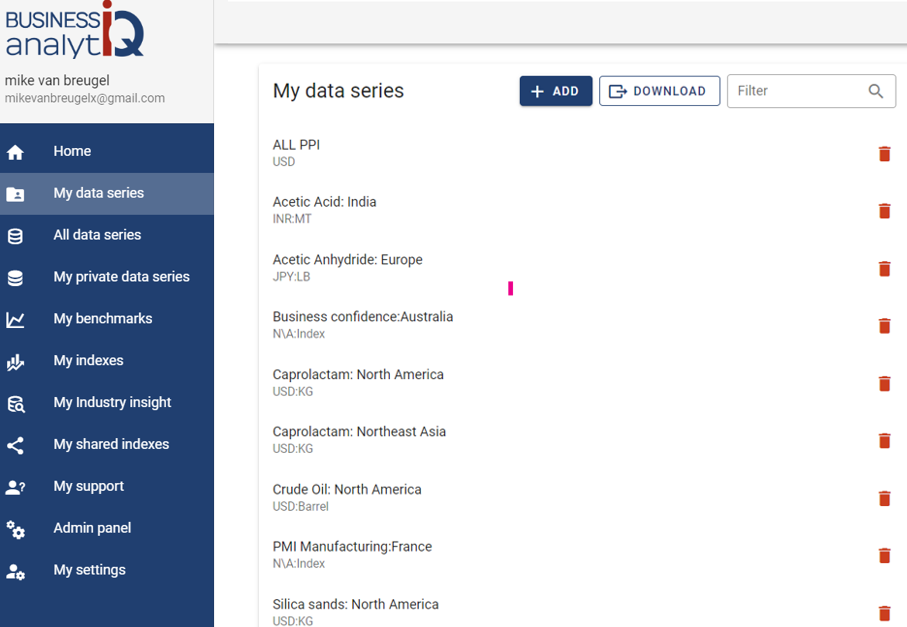

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page