Cryolite price November 2024 and outlook (see chart below)

- Northeast Asia:US$0.97/KG, -3% down

- Europe:US$0.66/KG, -4.3% down

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness.

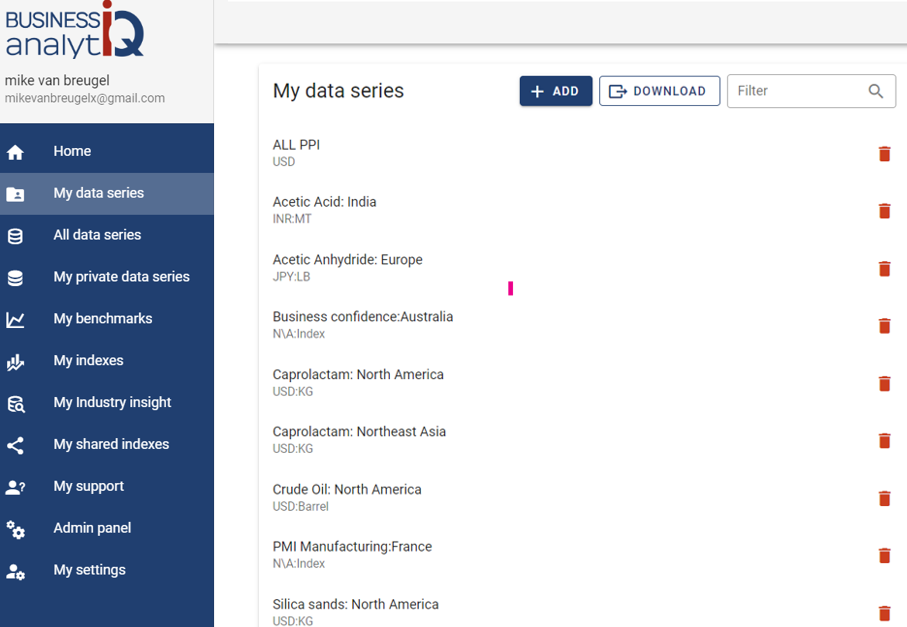

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Cryolite price index

This post is a summary of the Cryolite price developments. The price developments of Cryolite are expressed in US$ prices converted FX rates applicable at the time when the price was valid. Cryolitee price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Cryolite prices is generated from different inputs including:

- Very recent price developments of immediate cost drivers of Cryolite prices

- Recent price developments of underlying feedstocks which drive the price of Cryolite

- Market futures for both cost drives and feedstocks of Cryolite prices

- Adjustment of current supply/demand imbalances in the Cryolite market

- Longer term trends in likely demand conditions

Further information on the Cryolite price chart

What is Cryolite

Cryolite is an important mineral and industrial compound with a range of applications, particularly in the aluminum production industry. Below is a detailed overview addressing what cryolite is, how it is produced, its uses, and its key properties.

Cryolite is a rare sodium aluminum fluoride mineral with the chemical formula Na₃AlF₆. It appears as a white to colorless crystalline solid and has historically been significant in the extraction of aluminum from its ores.

How is Cryolite produced

Natural Production

Natural Cryolite: Historically, cryolite was mined from the Ivigtut mine in Greenland, discovered in the late 18th century. Natural cryolite is exceedingly rare, which limits its availability for industrial use.

Synthetic Production

Given the scarcity of natural cryolite, synthetic production is essential for industrial applications.

Chemical Synthesis: Synthetic cryolite is produced through a high-temperature reaction involving sodium fluoride (NaF) and aluminum fluoride (AlF₃).

Process Details:

Raw Materials: Sodium fluoride and aluminum fluoride are the primary reactants.

Conditions: The reaction is carried out in a furnace at temperatures exceeding 900°C to facilitate the formation of cryolite.

Purification: The resulting cryolite is purified to remove any unreacted materials or by-products, ensuring high purity suitable for industrial applications.

Alternative Methods

Research continues into alternative methods for producing cryolite, including more energy-efficient processes and the use of alternative raw materials, to reduce costs and environmental impact.

What is Cryolite used for

Cryolite’s primary application lies in the Hall-Héroult process for aluminum extraction. Additionally, it has several other uses across various industries.

Aluminum Production

Hall-Héroult Process: Cryolite serves as a solvent and electrolyte in the electrolysis of aluminum oxide (alumina) to produce aluminum metal.

Role: It lowers the melting point of alumina from about 2000°C to approximately 950°C, making the process more energy-efficient.

Function: Acts as a medium for the electrochemical reactions that separate aluminum from oxygen.

Chemical Industry

Flux in Metallurgical Processes: Used as a flux to remove impurities during the smelting of metals.

Catalyst: Employed in certain chemical reactions as a catalyst or a medium to enhance reaction rates.

Glass and Ceramics Manufacturing

Glass Production: Utilized in the production of specialty glasses and ceramics to modify melting temperatures and improve material properties.

Fluorine Source

Fluorinated Compounds: Serves as a precursor in the synthesis of various fluorinated chemicals and pharmaceuticals.

Refrigeration

Cryolite-Based Refrigerants: Investigated for use in refrigeration systems due to its low melting and boiling points, although not widely adopted.

Research and Development

Material Science: Used in research for developing new materials and understanding high-temperature processes.

What are the key characteristics of Cryolite

Chemical Properties

Chemical Formula: Na₃AlF₆

Molecular Weight: 178.00 g/mol

Structure: Orthorhombic crystal system; consists of sodium (Na⁺), aluminum (Al³⁺), and fluoride (F⁻) ions.

Solubility:

In Water: Slightly soluble, with solubility increasing at higher temperatures.

In Molten States: Highly soluble, which is crucial for its role in the Hall-Héroult process.

Physical Properties

Appearance: Typically white to colorless crystalline solid.

Crystal Habit: Often forms prismatic or granular crystals.

Melting Point: Approximately 1013°C (1855°F).

Boiling Point: Decomposes before boiling; thermal decomposition occurs around 1100°C.

Density: Around 2.95 g/cm³.

Hardness: Mohs hardness of 3.5, making it relatively soft.

Luster: Vitreous to pearly on cleavage surfaces.

Solubility in Water: Slightly soluble, increasing with temperature.

Thermal Properties

Heat Capacity: High heat capacity, aiding in the efficient transfer of heat during industrial processes.

Thermal Stability: Stable under the high-temperature conditions required for aluminum production, but decomposes at extremely high temperatures.

Electrical Properties

Electrical Conductivity: Excellent conductor when molten, facilitating the electrolysis process in aluminum extraction.

Optical Properties

Transparency: Transparent to translucent in thin crystals, but not typically used for optical applications.

How big is the global Cryolite market

Market Size and Growth

As of 2023, the global cryolite market was valued at approximately USD 250 million. The market has been experiencing steady growth, with an anticipated compound annual growth rate (CAGR) of around 4-5% from 2024 to 2030. This growth is primarily driven by the sustained demand for aluminum, advancements in synthetic cryolite production, and its applications in various industrial processes.

Key Drivers

Aluminum Production Demand

Hall-Héroult Process: Cryolite is indispensable in the electrolytic reduction of aluminum from alumina. The global demand for aluminum, driven by sectors such as automotive, aerospace, packaging, and construction, directly influences the cryolite market.

Advancements in Synthetic Production

Enhanced Manufacturing Techniques: Improvements in synthetic cryolite production have increased availability and reduced costs, making it more accessible for industrial use.

Growth in Electronics and Electrical Industries

Electrolyte Applications: The expanding electronics sector requires cryolite for the production of semiconductors and other components, boosting demand.

Investment in Emerging Economies

Industrial Expansion: Rapid industrialization in regions like Asia-Pacific, Latin America, and Africa increases the need for cryolite in various manufacturing processes.

Environmental Regulations and Sustainability

Recycling and Sustainability Initiatives: Efforts to recycle aluminum and reduce environmental impact promote the use of efficient processes that rely on cryolite.

Regional Insights

Asia-Pacific

Largest Market Share: Dominated by China, which is the world’s largest producer and consumer of aluminum. Rapid industrial growth and infrastructure development in countries like India, Japan, and South Korea further bolster the market.

North America

Significant Presence: The United States and Canada have substantial aluminum production facilities and research institutions focusing on advanced cryolite applications.

Europe

Stable Demand: Countries such as Germany, Russia, and Norway maintain steady demand through their robust aluminum industries and technological advancements.

Latin America and Middle East & Africa

Emerging Markets: Increasing investments in mining, manufacturing, and infrastructure projects contribute to growing cryolite demand in these regions.

Key Players

The global cryolite market is moderately fragmented, with several key players dominating the landscape. Major companies involved in the production and distribution of cryolite include:

Solvay S.A.

A leading global chemical company with significant operations in fluorine-based products, including synthetic cryolite.

BASF SE

One of the largest chemical producers globally, offering a range of fluorine compounds and intermediates.

Alcoa Corporation

Primarily an aluminum producer, Alcoa also engages in the production and supply of cryolite as part of its integrated operations.

Kawasaki Kasei Corporation

A Japanese company involved in the production of various chemicals, including synthetic cryolite.

Futurity (China) Co., Ltd.

A major player in the Asian market, focusing on the synthesis and distribution of cryolite for industrial applications.

Future Outlook

The cryolite market is expected to continue its growth trajectory over the next decade, supported by several factors:

Sustained Aluminum Demand

As global infrastructure projects and lightweight material applications (e.g., in automotive and aerospace industries) grow, the demand for aluminum—and consequently cryolite—will remain robust.

Technological Innovations

Ongoing research into more efficient and environmentally friendly cryolite production methods will enhance market growth and sustainability.

Expansion of Renewable Energy Projects

The increasing focus on renewable energy sources, such as wind turbines and electric vehicles, which rely on aluminum components, will drive cryolite demand.

Recycling and Circular Economy Initiatives

Enhanced aluminum recycling processes, which may utilize cryolite, contribute to market expansion by promoting sustainable practices.

Challenges

Despite positive growth prospects, the cryolite market faces several challenges:

Environmental and Safety Regulations

Strict regulations regarding the handling, storage, and disposal of cryolite can increase operational costs and limit market expansion.

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials used in synthetic cryolite production (e.g., sodium fluoride and aluminum fluoride) can impact profitability and market stability.

Alternative Technologies

Advances in alternative materials and processes for aluminum production may reduce reliance on cryolite in the long term.

Opportunities

Emerging Applications

Exploration of new applications in advanced materials, nanotechnology, and specialized chemical processes presents growth opportunities.

Geographical Expansion

Expanding production facilities in emerging economies can tap into new markets and reduce dependency on traditional regions.

Sustainable Production Practices

Developing greener production methods can meet regulatory requirements and appeal to environmentally conscious consumers and industries.

Conclusion

The global cryolite market is a specialized yet vital segment within the broader chemical and aluminum industries. Valued at approximately USD 250 million in 2023, the market is poised for steady growth driven by sustained aluminum demand, advancements in synthetic production, and expanding industrial applications. While challenges such as regulatory constraints and raw material price volatility exist, opportunities in emerging markets, technological innovations, and sustainable practices offer promising avenues for market expansion. Key players continue to invest in strategic partnerships and production enhancements to maintain and grow their market presence in this niche but essential industry.