Blue hydrogen price February 2025 and outlook (see chart below)

- Europe:US$3.74/KG, 4.8% up

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness.

Blue Hydrogen price index

This post is a summary of Blue Hydrogen developments. The price developments of Blue Hydrogen are expressed in US$ prices converted FX rates applicable at the time when the price was valid. Blue Hydrogen price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Blue Hydrogen prices, on the second tab, is generated from different inputs including:

- Very recent price developments of immediate cost drivers of Blue Hydrogen prices

- Recent price developments of underlying feedstocks which drive the price of Blue Hydrogen

- Market futures for both cost drives and feedstocks of Blue Hydrogen prices

- Adjustment of current supply/demand imbalances in the Blue Hydrogen market

- Longer term trends in likely demand conditions

Further information on the Blue Hydrogen price index

What is Blue Hydrogen

Hydrogen is the simplest and most abundant element in the universe, commonly found in molecular form as H2. It is colorless, odorless, and tasteless. Hydrogen has a wide range of applications, including industrial processes, energy production, and as a fuel for vehicles.

The difference between green, blue, and grey hydrogen lies in how they are produced and their environmental impact:

Green Hydrogen

Green hydrogen is produced through electrolysis, a process that uses electricity to split water into hydrogen and oxygen. When this electricity comes from renewable sources such as wind or solar power, the hydrogen is considered green because the production process is emissions-free.

Green hydrogen is seen as a sustainable and environmentally friendly option since it does not produce greenhouse gas emissions during production.

Blue Hydrogen

Blue hydrogen is produced through a process called steam methane reforming (SMR) or autothermal reforming (ATR), where natural gas is converted into hydrogen and carbon dioxide (CO2).

The key difference between blue and grey hydrogen is that in the blue hydrogen production process, the CO2 emissions are captured and stored using carbon capture and storage (CCS) technology. This means that although CO2 is emitted during production, it is not released into the atmosphere.

Blue hydrogen is considered a transitional option, as it reduces emissions compared to grey hydrogen but still relies on fossil fuels.

Grey Hydrogen

Grey hydrogen is the most common form of hydrogen produced today. It is also produced through SMR or ATR, but unlike blue hydrogen, the CO2 emissions produced during the process are released into the atmosphere.

Grey hydrogen production contributes to greenhouse gas emissions and is not considered environmentally friendly.

In summary, the main difference between green, blue, and grey hydrogen lies in the carbon footprint of their production processes, with green being the most environmentally friendly, followed by blue as a transitional option, and grey having the highest emissions.

What are the industrial applications of Blue Hydrogen

Hydrogen has numerous industrial applications across various sectors due to its unique properties and versatility. Some key industrial applications for hydrogen include:

Chemical Production

Hydrogen is a crucial feedstock for the production of various chemicals, including ammonia, methanol, and hydrogen chloride. These chemicals are used in the manufacturing of fertilizers, plastics, pharmaceuticals, and other industrial products.

Refining

Hydrogen is widely used in petroleum refining processes to remove sulfur impurities from crude oil and refine petroleum products such as gasoline, diesel, and jet fuel. Hydrogen is also used in hydrocracking and hydrotreating processes to improve the quality and yield of refined products.

Metallurgy

Hydrogen is utilized in metallurgical processes for the reduction of metal ores and the production of metals such as iron and steel. It is also used in annealing and heat treating operations to improve the properties of metal products.

Food Processing

Hydrogenation is a process used in the food industry to convert unsaturated fats and oils into saturated fats. This process is used in the production of margarine, shortening, and other food products.

Electronics

Hydrogen is used in the electronics industry for the production of semiconductors, flat-panel displays, and other electronic devices. It is employed in the manufacturing of silicon wafers and as a carrier gas in chemical vapor deposition processes.

Power Generation

Hydrogen can be used as a fuel in gas turbines and internal combustion engines for power generation. It can also be used in fuel cells to generate electricity through an electrochemical reaction with oxygen, with water as the only byproduct.

Fertilizer Production

Hydrogen is a key component in the Haber-Bosch process, which is used to produce ammonia for fertilizer production. Ammonia is a primary source of nitrogen for plant growth and is essential for agricultural productivity.

Textile Industry

Hydrogen is used in the textile industry for bleaching, desizing, and dyeing processes. It is also used in the production of synthetic fibers such as nylon and polyester.

These are just a few examples of the many industrial applications of hydrogen. As research and technology continue to advance, new applications for hydrogen are continually being explored, particularly in the context of transitioning to a low-carbon economy.

What is Hydrogen used for?

Hydrogen has a wide range of uses across various industries due to its versatile properties. Some of the common uses of hydrogen include:

Fuel Cells

One of the most promising applications of hydrogen is in fuel cells. Hydrogen fuel cells generate electricity through an electrochemical reaction between hydrogen and oxygen, with water as the only byproduct. Fuel cells can power vehicles, provide backup power for buildings, and serve as portable power sources.

Energy Storage

Hydrogen can be stored and used as an energy carrier to store excess renewable energy generated from sources like wind and solar power. This stored hydrogen can then be converted back into electricity when needed, helping to balance supply and demand in the grid.

Chemical Production

Hydrogen is a key ingredient in the production of various chemicals, including ammonia, methanol, and petroleum refining processes. It is also used in the production of fertilizers, plastics, and pharmaceuticals.

Metal Processing

Hydrogen is used in metal refining and processing industries. It is employed in processes like hydrogenation, desulfurization, and hydrocracking in the petroleum industry to improve the quality of fuels.

Food Industry

Hydrogen is used in the food industry for hydrogenation processes, such as the production of margarine and vegetable oils.

Electronics

Hydrogen is used in the production of semiconductors, flat-panel displays, and other electronic devices.

Aerospace

Hydrogen is used as a rocket fuel in the aerospace industry due to its high energy density and efficiency.

Welding

Hydrogen is used as a shielding gas in welding applications, particularly for welding reactive metals like titanium and stainless steel.

These are just a few examples of the many applications of hydrogen. As research and technology advance, new uses for hydrogen continue to emerge, particularly in the context of transitioning to a more sustainable energy economy.

What drives the price of the different types of Hydrogen

The prices of different types of hydrogen, such as green, blue, and grey hydrogen, are influenced by various factors, including production methods, feedstock costs, technology advancements, market demand, and government policies. Here’s how these factors can affect the prices of each type of hydrogen:

Production Methods

Green Hydrogen

The cost of green hydrogen is primarily influenced by the cost of renewable electricity used in the electrolysis process. As the cost of renewable energy sources like solar and wind decreases, the cost of green hydrogen tends to decrease as well.

Blue Hydrogen

Blue hydrogen production costs are affected by the costs associated with natural gas feedstock, steam methane reforming (SMR) or autothermal reforming (ATR) processes, and carbon capture and storage (CCS) technologies. Advances in CCS technology and economies of scale can help reduce the cost of blue hydrogen.

Grey Hydrogen

The cost of grey hydrogen is mainly determined by the cost of natural gas feedstock and the efficiency of the steam methane reforming process. Fluctuations in natural gas prices can impact the cost of grey hydrogen.

Feedstock Costs

The prices of feedstocks such as renewable electricity (for green hydrogen), natural gas (for blue and grey hydrogen), and water can significantly influence hydrogen production costs.

Technology Advancements

Technological advancements in electrolysis, steam methane reforming, carbon capture and storage, and other related processes can lead to cost reductions and efficiency improvements, thereby impacting the prices of different types of hydrogen.

Market Demand

Growing demand for hydrogen in sectors such as transportation, industry, and energy storage can affect prices. Increased demand may drive investments in production capacity and infrastructure, potentially leading to economies of scale and cost reductions.

Government Policies and Incentives

Government policies, regulations, and incentives play a significant role in shaping the hydrogen market. Subsidies, tax incentives, carbon pricing mechanisms, and mandates to reduce greenhouse gas emissions can influence the competitiveness of different types of hydrogen.

Infrastructure Development

The availability and development of infrastructure for hydrogen production, distribution, storage, and utilization can impact prices. Investments in infrastructure can help reduce transportation costs and improve market access for hydrogen.

Overall, the prices of different types of hydrogen are dynamic and subject to various market, technological, and policy-related factors. As renewable energy becomes more cost-competitive and governments prioritize decarbonization efforts, the cost competitiveness of green hydrogen is expected to improve relative to conventional grey hydrogen. Similarly, advancements in carbon capture and storage technologies can enhance the competitiveness of blue hydrogen compared to grey hydrogen.

What are the properties of hydrogen

Hydrogen is a unique and versatile element with several distinctive properties:

Atomic Structure

Hydrogen is the simplest element in the periodic table, consisting of only one proton and one electron in its nucleus. It is the lightest and most abundant element in the universe.

Colorless and Odorless

Hydrogen gas is colorless, odorless, and tasteless, making it difficult to detect without specialized equipment.

Highly Reactive

Hydrogen is highly reactive, readily forming chemical bonds with other elements. It can react with oxygen to form water (H2O), with halogens to form hydrogen halides (e.g., HCl), and with metals to form metal hydrides.

Flammability

Hydrogen is highly flammable when mixed with air or oxygen. It has a wide flammability range and can ignite at concentrations as low as 4% in air.

Low Density

Hydrogen gas has a low density, making it lighter than air. This property makes hydrogen useful as a lifting gas in balloons and airships.

High Energy Content

Hydrogen has the highest energy content per unit mass of any fuel, making it an efficient energy carrier. When combusted or used in fuel cells, hydrogen releases energy in the form of heat or electricity.

Boiling and Melting Points

Hydrogen has a low boiling point (-252.87°C or -423.17°F) and a low melting point (-259.14°C or -434.45°F), which are the lowest among all elements.

Diatomic Molecule

In its most common molecular form, hydrogen exists as H2, meaning it consists of two hydrogen atoms covalently bonded together. This diatomic molecule is the stable form of hydrogen under standard conditions.

Good Thermal Conductivity

Hydrogen gas has good thermal conductivity, making it useful in various industrial applications such as cooling generators and electrical equipment.

These properties make hydrogen a valuable element with diverse applications across industries, including energy production, chemical manufacturing, aerospace, and electronics. However, harnessing hydrogen’s potential often requires careful handling due to its flammability and reactivity.

How big is the global hydrogen market

The global hydrogen market size was valued at several billion dollars annually, with projections indicating significant growth in the coming years. Factors contributing to this growth include:

Demand from Various Sectors

The demand for hydrogen comes from various sectors such as transportation (including fuel cell vehicles and hydrogen-powered trains), industrial processes (e.g., refining, chemical production), energy storage, and power generation.

Government Policies and Investments

Many governments around the world have been implementing policies and making investments to promote hydrogen as a clean energy carrier. These initiatives include funding research and development, supporting infrastructure development, and offering incentives for hydrogen adoption.

Technological Advancements

Advances in hydrogen production, storage, and distribution technologies are making hydrogen more economically viable and scalable, further driving market growth.

Decarbonization Efforts

The increasing focus on reducing carbon emissions and transitioning to renewable energy sources is boosting the demand for hydrogen as a clean and versatile energy carrier.

Emerging Applications

New and innovative applications for hydrogen, such as its use in industrial processes, synthetic fuels, and grid balancing, are expanding the market opportunities for hydrogen.

According to https://oec.world/en:

In 2021 Hydrogen were the world’s 3675th most traded product (out of 4,641).

In 2021, the top exporters of Hydrogen were Belgium ($61.3M), Canada ($57.8M), Netherlands ($25.5M), Chinese Taipei ($15.6M), and United States ($14.2M).

In 2021, the top importers of Hydrogen were Netherlands ($59.7M), United States ($57.6M), Singapore ($23.1M), France ($15.7M), and Germany ($5.73M).

Given these factors, the global hydrogen market is expected to continue growing significantly in the coming years, with some forecasts projecting it to reach tens of billions of dollars annually by the end of the decade. However, the exact size of the market can vary depending on factors such as technological advancements, policy developments, and market dynamics.

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

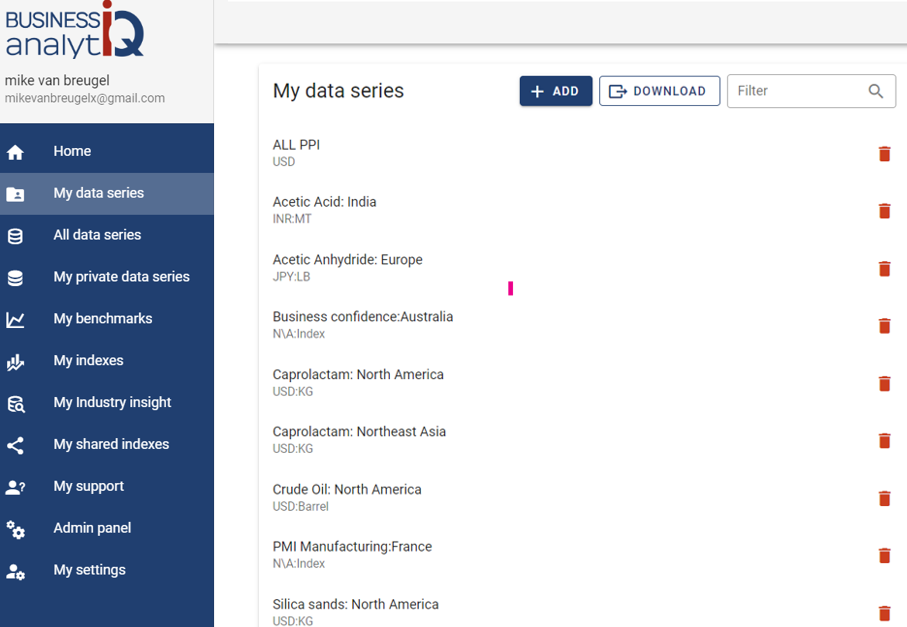

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page