Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness.

Coffee price index (Robusta)

This post is a summary of the Coffee price index (Robusta) developments since 2005 as per the IMF. The developments are expressed as an index and not in absolute terms. Therefore the Coffee price index (Robusta) means that the values provided are relative to Jan 1 2019 which is defined as 1.00.

Further information on the Robust Coffee price index

What types of coffee beans are there

There are many types of coffee, which can be broadly classified into two main categories: arabica and robusta.

Arabica

Arabica is the most widely consumed type of coffee and accounts for about 75% of global production. It is a high-quality, mild-flavored coffee that is grown at high altitudes in regions such as Central and South America, Africa, and the Middle East. Arabica beans are oval-shaped and have a smooth, rounded flavor.

Robusta

Robusta is the second most widely consumed type of coffee and accounts for about 25% of global production. It is a lower-quality, bitter-tasting coffee that is grown at lower altitudes in regions such as Africa and Asia. Robusta beans are round and have a stronger, more bitter flavor than arabica beans.

Which countries produce the most coffee

Coffee is grown in many countries around the world, with the majority of production concentrated in developing countries in the tropics. According to the International Coffee Organization, the top five coffee-producing countries in 2020 were:

Brazil

Brazil was the largest producer of coffee in 2020, with an estimated output of 2.9 million metric tons.

Vietnam

Vietnam was the second-largest producer of coffee, with an estimated output of 2.3 million metric tons.

Colombia

Colombia was the third-largest producer of coffee, with an estimated output of 1.1 million metric tons.

Indonesia

Indonesia was the fourth-largest producer of coffee, with an estimated output of 939,000 metric tons.

Ethiopia

Ethiopia was the fifth-largest producer of coffee, with an estimated output of 715,000 metric tons.

Other significant coffee-producing countries include Mexico, Peru, and Honduras. Overall, coffee is an important agricultural commodity that is grown in many countries around the world and is a major source of income for millions of small farmers and their families.

How big is the global coffee market

The global coffee market is large and growing, with demand driven by the widespread popularity of coffee as a beverage. According to a report by Mordor Intelligence, the global coffee market was valued at approximately USD 148.3 billion in 2020 and is expected to reach USD 186.7 billion by 2025, at a compound annual growth rate of 4.5%.

The Asia-Pacific region is the largest market for coffee, followed by Europe and North America. The growth in the Asia-Pacific region is driven by the increasing demand for specialty and premium coffee, while the demand in Europe and North America is driven by the growing popularity of single-serve coffee makers and coffee shops.

Overall, the demand for coffee is likely to remain strong in the coming years due to the widespread popularity of the beverage and the growing demand for specialty and premium coffee products. However, the coffee market is subject to fluctuations in price and supply due to factors such as weather conditions, disease outbreaks, and economic conditions in coffee-producing countries.

Further information

Data source: IMF

This data has been partly provided by the IMF and the World Bank. The only change is that it has been indexed for Jan 2019 (so Jan 2019 is set as the index 1.00). The data is provided subject to the terms and conditions as defined by the IMF

Business Analytiq

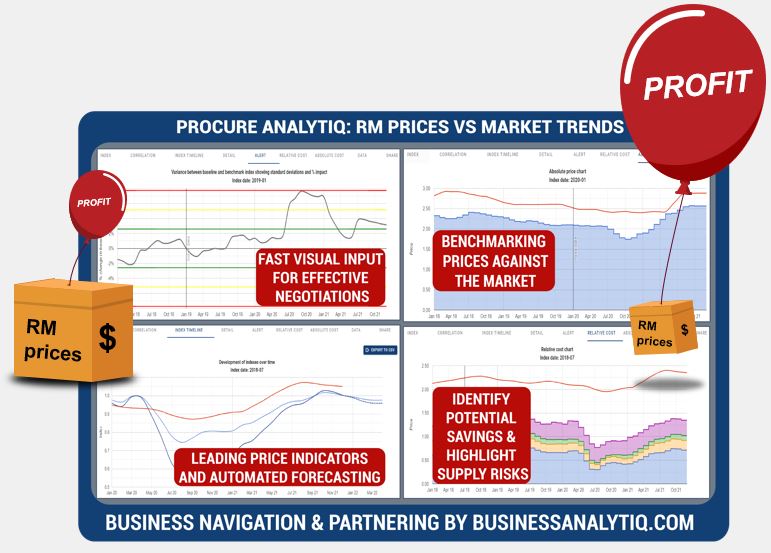

BE THE FIRST TO SEE RISK AND OPPORTUNITY!

BusinessAnalytiq provides unlimited market trend data and an online tools to track market developments, key benchmarks & leading indicators.

BusinessAnalytiq leads to price visibility, better negotiations, easier budgeting and forecasting, lower raw material prices, and improved better internal and external communication. BusinessAnalytiq will decrease risk and higher profit.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page