Dibutyl Phthalate (DBP)l price February 2025 and outlook (see chart below)

- Northeast Asia:US$1.16/KG, 1.8% up

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness.

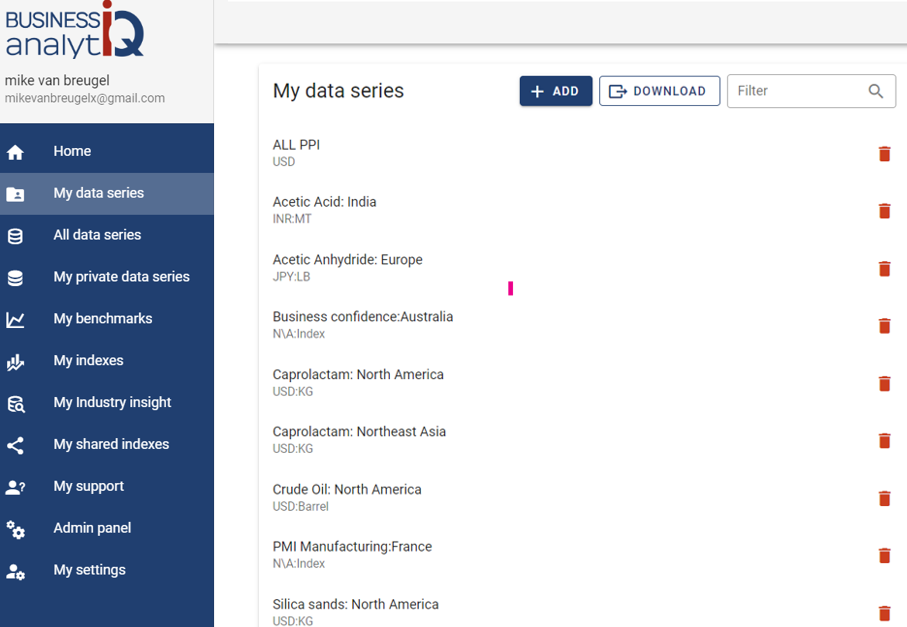

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Dibutyl Phthalate (DBP) price index

This post is a summary of the Dibutyl Phthalate (DBP) price developments. The price developments of Dibutyl Phthalate (DBP) are expressed in US$ prices converted FX rates applicable at the time when the price was valid. Dibutyl Phthalate (DBP)l price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Dibutyl Phthalate (DBP) prices is generated from different inputs including:

- Very recent price developments of immediate cost drivers of Dibutyl Phthalate (DBP) prices

- Recent price developments of underlying feedstocks which drive the price of Dibutyl Phthalate (DBP)

- Market futures for both cost drives and feedstocks of Dibutyl Phthalate (DBP) prices

- Adjustment of current supply/demand imbalances in the Dibutyl Phthalate (DBP) market

- Longer term trends in likely demand conditions

Further information on the Dibutyl Phthalate (DBP) price chart

What is Dibutyl Phthalate (DBP)

Dibutyl phthalate (DBP) is an organic compound and a widely used plasticizer, which softens plastics, especially PVC (polyvinyl chloride). Its chemical formula is C16H22O4. DBP is a colorless to faintly yellow oily liquid, typically with a slight odor.

How is Dibutyl Phthalate (DBP) produced

DBP is produced through esterification. This process involves reacting phthalic anhydride with butanol in the presence of a catalyst (usually sulfuric acid or p-toluenesulfonic acid). The reaction yields dibutyl phthalate and water as a by-product.

What is Dibutyl Phthalate (DBP) used for

Plasticizer

Primarily used to make flexible plastics, especially in PVC applications such as flooring, cables, and packaging materials.

Adhesives and Sealants

DBP is also used in the production of adhesives and sealants.

Cosmetics

It is found in nail polishes and other personal care products as a film-forming agent.

Inks and Coatings: DBP is used in printing inks, lacquers, and coatings.

How big is the global Dibutyl Phthalate (DBP) market

The global Dibutyl Phthalate (DBP) market is relatively niche but plays a crucial role in industries where it is used as a plasticizer, especially in the production of flexible PVC and coatings. Below is an overview of the market size, growth drivers, and trends.

Market Size and Growth

Market Valuation (2023): The global DBP market was valued at approximately USD 400-500 million in 2023.

Growth Rate: The market is expected to grow at a CAGR of around 3-4% from 2023 to 2030, primarily driven by demand from developing economies and industrial applications, especially in flexible PVC products.

Key Drivers

Plasticizers for PVC: DBP is used to make flexible polyvinyl chloride (PVC) products like cables, flooring, and films.

Adhesives and Coatings: Growing demand for adhesives, sealants, and coatings, particularly in the construction and automotive sectors, boosts DBP demand.

Emerging Markets: Increased industrialization and infrastructure projects in regions like Asia-Pacific drive demand for plasticized materials.

Challenges

Regulations: Many regions (e.g., EU, U.S.) have restricted DBP use due to health concerns, particularly in toys and cosmetics, which may limit its growth.

Conclusion

The DBP market, though facing regulatory challenges, is poised for moderate growth due to its ongoing use in industrial and construction applications.