EPDM rubber price April 2024 and outlook (see chart below)

- North America:US$2.34/KG, -2.9% down

- Europe:US$2.46/KG, -3.1% down

- Northeast Asia:US$2.82/KG, -3.4% down

- Southeast Asia:US$1.82/KG, -3.2% down

- South America:US$2.66/KG, -0.4% down

- Middle East:US$1.98/KG, -3.4% down

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness.

EPDM rubber price index

This post is a summary of the EPDM rubber developments. The price developments of EPDM rubber are expressed in US$ prices converted FX rates applicable at the time when the price was valid. EPDM rubber price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for EPDM rubber prices, on the second tab, is generated from different inputs including:

- Very recent price developments of immediate cost drivers of EPDM rubber prices

- Recent price developments of underlying feedstocks which drive the price of EPDM rubber

- Market futures for both cost drives and feedstocks of EPDM rubber prices

- Adjustment of current supply/demand imbalances in the EPDM rubber market

- Longer term trends in likely demand conditions

Further information on the EPDM price chart

What is EPDM rubber

EPDM (ethylene propylene diene monomer) rubber is a synthetic rubber made from a mixture of ethylene and propylene, along with a small amount of a diene monomer. This type of rubber has excellent resistance to weathering, ozone, and UV radiation, making it a popular choice for outdoor applications.

EPDM rubber is known for its ability to withstand extreme temperatures, from -50°C to 150°C, as well as its resistance to chemicals, acids, and alkalis. It also has good electrical insulation properties and low water absorption.

EPDM rubber is commonly used in the automotive industry for seals, hoses, and belts, as well as in construction for roofing membranes, waterproofing materials, and seals. It is also used in the manufacturing of electrical insulation, appliance components, and industrial gaskets.

What is EPDM rubber used for

EPDM rubber is used in a wide variety of applications due to its excellent resistance to weathering, UV radiation, and extreme temperatures. Here are some common uses of EPDM rubber:

Automotive industry

EPDM rubber is used for making seals, gaskets, hoses, and belts in cars and other vehicles.

Construction industry

EPDM rubber is used for roofing membranes, waterproofing materials, and seals.

Electrical industry

EPDM rubber is used for making electrical insulation, cable jackets, and wire seals.

Industrial applications

EPDM rubber is used for making gaskets, O-rings, and other components that require chemical resistance and high-temperature resistance.

Marine industry

EPDM rubber is used for making seals, gaskets, and hoses that are exposed to saltwater and harsh marine environments.

HVAC industry

EPDM rubber is used for making seals and gaskets for air conditioning and ventilation systems.

Consumer goods industry

EPDM rubber is used for making garden hoses, sporting equipment, and toys.

Overall, EPDM rubber is a versatile material that is used in a wide range of applications due to its durability and resistance to environmental factors.

How is EPDM rubber produced

EPDM (ethylene propylene diene monomer) rubber is produced through a polymerization process that involves the use of catalysts, monomers, and initiators. The basic steps involved in the production of EPDM rubber are as follows:

Mixing

The monomers of ethylene, propylene, and diene are mixed with small amounts of additives such as curing agents, antioxidants, and processing aids.

Polymerization

The monomer mixture is then heated to a high temperature in the presence of a catalyst, which initiates the polymerization reaction. The reaction continues until the desired molecular weight and polymer structure is achieved.

Stripping

After the polymerization is complete, the unreacted monomers are removed from the mixture through a process called stripping.

Recovery

The stripped monomers are then recovered for reuse, and the resulting EPDM rubber is further processed by adding curing agents, fillers, and other additives to achieve the desired properties.

Shaping

The EPDM rubber is then shaped into the desired form using processes such as extrusion, molding, or calendaring.

Overall, the production of EPDM rubber is a complex process that requires careful control of various parameters such as temperature, pressure, and composition to ensure that the resulting rubber has the desired properties for the intended application.

What drives the cost of EPDM rubber

The cost of EPDM (ethylene propylene diene monomer) rubber is influenced by various factors, including:

Raw materials

The prices of the raw materials used to produce EPDM rubber, such as ethylene, propylene, and diene monomers, can impact the cost of the final product. Fluctuations in the prices of these raw materials can lead to fluctuations in the cost of EPDM rubber.

Energy costs

The energy required to produce EPDM rubber, such as electricity and natural gas, can also impact the cost of the final product. Fluctuations in energy prices can have a significant impact on the overall production costs.

Manufacturing processes

The efficiency of the manufacturing processes used to produce EPDM rubber can also impact the cost of the final product. Improvements in process efficiency can help to reduce production costs, while inefficiencies can lead to higher costs.

Market demand

The level of demand for EPDM rubber in various applications and industries can also impact its cost. High demand can lead to higher prices, while low demand can result in lower prices.

Competition

The level of competition in the EPDM rubber market can also impact its cost. Increased competition can lead to lower prices, while a lack of competition can result in higher prices.

Overall, the cost of EPDM rubber is influenced by a range of factors, including raw materials, energy costs, manufacturing processes, market demand, and competition.

What types of EPDM rubber are there

EPDM (ethylene propylene diene monomer) rubber can be classified into various types based on their molecular structure, curing mechanism, and other properties. Here are some common types of EPDM rubber:

Ethylene-Propylene Rubber (EPR)

EPR is a copolymer of ethylene and propylene, and it is the most common type of EPDM rubber. It has excellent weather resistance, heat resistance, and electrical insulation properties.

Diene-Modified EPDM (M-class)

M-class EPDM rubber is produced by adding a third monomer, a diene, to the EPR polymerization process. This modification improves the cure characteristics of the rubber, making it easier to process and improve its mechanical properties.

Peroxide-Cured EPDM

Peroxide-cured EPDM rubber is cured using a peroxide curing agent, which leads to improved heat resistance, better compression set resistance, and higher mechanical strength.

Sulfur-Cured EPDM

Sulfur-cured EPDM rubber is cured using sulfur-based curing agents. This type of EPDM rubber is cost-effective and is commonly used in low-stress applications.

High Molecular Weight EPDM

High molecular weight EPDM rubber is produced by increasing the molecular weight of the polymer through a longer polymerization process. This results in a higher viscosity material that has improved mechanical properties and can be used in high-stress applications.

Low Temperature EPDM

Low-temperature EPDM rubber is designed to withstand low-temperature environments and has a lower glass transition temperature than other types of EPDM rubber.

Overall, the different types of EPDM rubber offer different properties and are used in a wide range of applications. The selection of the type of EPDM rubber depends on the specific requirements of the application.

What are the specific properties of EPDM rubber

EPDM (ethylene propylene diene monomer) rubber is widely used in industrial applications due to its unique properties, including:

Excellent Weather Resistance

EPDM rubber has excellent weathering resistance, making it ideal for outdoor applications. It can withstand exposure to UV radiation, ozone, and extreme temperatures, without significant degradation.

Good Chemical Resistance

EPDM rubber is resistant to a wide range of chemicals, including acids, alkalis, and solvents. This makes it suitable for use in chemical processing and transportation applications.

High Heat Resistance

EPDM rubber can withstand high temperatures, making it suitable for use in high-temperature applications. It can withstand temperatures up to 150°C (302°F) for short periods and up to 120°C (248°F) for extended periods.

Good Electrical Insulation Properties

EPDM rubber is an excellent electrical insulator and can be used in applications where electrical insulation is required.

Good Water Resistance

EPDM rubber has good water resistance, making it suitable for use in applications where exposure to water is common.

Excellent Elasticity and Flexibility

EPDM rubber has excellent elasticity and flexibility, making it suitable for use in dynamic applications such as seals, gaskets, and hoses.

Good Tear Resistance

EPDM rubber has good tear resistance, which makes it durable and suitable for use in applications where the material is subjected to repeated stress or impact.

Overall, the combination of these properties makes EPDM rubber suitable for a wide range of industrial applications, including automotive, construction, electrical, and industrial applications.

Which countries produce the most EPDM rubber

The production of EPDM (ethylene propylene diene monomer) rubber is concentrated in a few countries. According to the latest available data from 2019, the top 5 producers of EPDM rubber, in descending order, are:

China

China is the world’s largest producer of EPDM rubber, accounting for approximately 45% of global production. China has a significant domestic demand for EPDM rubber, as well as a strong export market.

United States

The United States is the second-largest producer of EPDM rubber, accounting for approximately 15% of global production. The U.S. is a major producer of EPDM rubber for automotive and construction applications.

Japan

Japan is the third-largest producer of EPDM rubber, accounting for approximately 10% of global production. Japanese companies are known for their expertise in producing high-quality EPDM rubber.

Germany

Germany is the fourth-largest producer of EPDM rubber, accounting for approximately 9% of global production. German companies are known for their advanced technology and high-quality products.

South Korea

South Korea is the fifth-largest producer of EPDM rubber, accounting for approximately 6% of global production. South Korean companies have invested heavily in developing new EPDM rubber products for various applications.

Overall, these countries dominate the production of EPDM rubber, and the majority of global production is centered in Asia.

How big is the global EPDM market

The global EPDM rubber market was valued at approximately USD 5.5 billion in 2020 and is projected to reach USD 7.6 billion by 2027, growing at a compound annual growth rate (CAGR) of around 4.5% during the forecast period (2021-2027). The growth of the EPDM rubber market is attributed to the increasing demand for this material in various applications, such as automotive, construction, electrical, and industrial.

The automotive industry is the largest end-use market for EPDM rubber, accounting for a significant share of the global market. This is due to the increasing demand for EPDM rubber in the production of seals, gaskets, hoses, and other components used in cars and other vehicles.

The construction industry is also a significant market for EPDM rubber, with growing demand for roofing membranes, waterproofing materials, and seals. The increasing demand for green buildings and sustainable construction materials is expected to drive the growth of this market segment in the coming years.

Overall, the global EPDM rubber market is expected to continue growing due to the increasing demand for this material in a wide range of applications and industries.

According to: https://oec.world/

Ethylene-propylene diene rubber (EPDM) are the world’s 1460th most traded product.

In 2020, the top exporters of Ethylene-propylene diene rubber (EPDM) were United States ($444M), South Korea ($229M), Netherlands ($198M), Japan ($154M), and Saudi Arabia ($100M).

In 2020, the top importers of Ethylene-propylene diene rubber (EPDM) were China ($282M), Belgium ($163M), Germany ($108M), United States ($90.8M), and Mexico ($67.1M).

Further reading

Business Analytiq

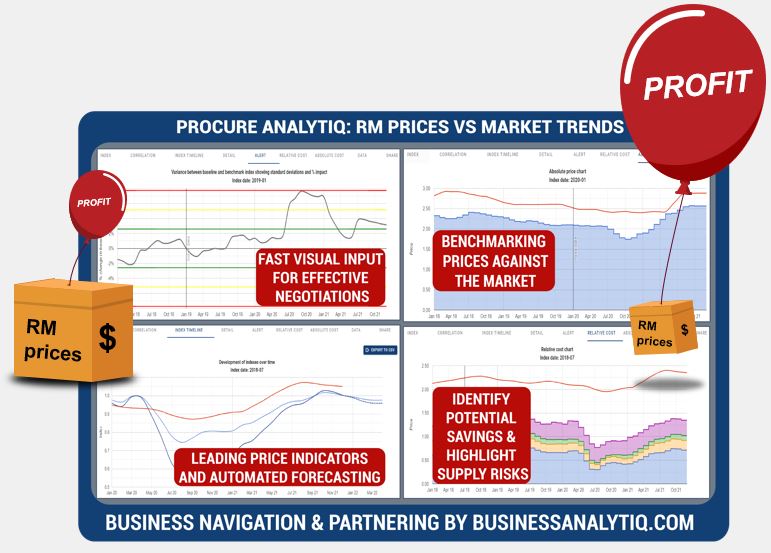

BE THE FIRST TO SEE RISK AND OPPORTUNITY!

BusinessAnalytiq provides unlimited market trend data and an online tools to track market developments, key benchmarks & leading indicators.

BusinessAnalytiq leads to price visibility, better negotiations, easier budgeting and forecasting, lower raw material prices, and improved better internal and external communication. BusinessAnalytiq will decrease risk and higher profit.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page