Fuel Oil price April 2024 and outlook (see chart below)

- North America:US$1.23/KG, unchanged

- Europe:US$1.17/KG, -0.8% down

- Northeast Asia:US$0.67/KG, -1.5% down

- South America:US$0.92/KG, -1.1% down

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness.

Fuel Oil price index

This post is a summary of the Fuel Oil price index developments since 2017. The price developments are expressed as a price index in US$ prices converted at current FX rates, which are the FX rates applicable at the time the price was valid. Fuel Oil price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

Further information on the Fuel Oil price index

What is fuel oil and what is it used for

Fuel oil is a liquid fuel that is used for heating and industrial purposes. It is typically made from crude oil, which is a mixture of hydrocarbons that is extracted from the ground. There are several different types of fuel oil, including:

No. 2 heating oil

This is the most common type of fuel oil and is used for heating homes and buildings. It is also known as “home heating oil” or “diesel fuel.”

No. 4 fuel oil

This type of fuel oil is used in industrial settings, such as factories and power plants. It is heavier and more viscous than No. 2 heating oil.

No. 5 and No. 6 fuel oils

These are even heavier and more viscous than No. 4 fuel oil and are used in industrial settings. They are also known as “residual fuel oils.”

Fuel oil is typically stored in tanks and is delivered to homes and businesses by truck. It is burned in a furnace or boiler to generate heat, which is then distributed through a building’s heating system. Fuel oil is an important source of energy for many countries and is used to heat homes, power vehicles, and fuel industrial processes.

How is fuel oil produced

Fuel oil is a liquid fuel that is produced from crude oil through a refining process. Crude oil is a mixture of hydrocarbons that is extracted from the ground and is composed of a variety of different types of hydrocarbons, including alkanes, cycloalkanes, and aromatic hydrocarbons.

The process of producing fuel oil begins with the separation of crude oil into different fractions based on their boiling points. This is typically done in a distillation column, where the crude oil is heated to a high temperature and the different fractions are collected at different points in the column based on their boiling points. The fuel oil fraction is collected from the bottom of the column and is typically a mixture of hydrocarbons with carbon atoms in the range of 16 to 20.

After the fuel oil fraction is collected, it is treated with hydrogen to remove impurities and improve its performance. The fuel oil is then further refined and treated to remove any remaining impurities, such as sulfur and other contaminants. The final product is a heavy, viscous liquid that is ready to be used as fuel.

There are several different types of fuel oil, including No. 2 heating oil, No. 4 fuel oil, and No. 5 and No. 6 fuel oils, which are used for a variety of purposes, including heating homes and buildings, powering industrial processes, and as a feedstock in the chemical industry.

How big is the global Fuel Oil market

The fuel oil market is a significant part of the global energy market. Fuel oil is widely used as a heating fuel, as a power source for industrial processes, and as a feedstock in the chemical industry. According to the International Energy Agency, global demand for fuel oil was approximately 3.3 million barrels per day in 2019.

The demand for fuel oil varies by region and is influenced by a number of factors, including economic growth, energy prices, and weather patterns. Some of the largest markets for fuel oil include the United States, China, and Europe, which together account for a significant portion of global demand.

In recent years, there has been a trend towards increased use of alternative fuels, such as natural gas and renewable energy sources, which has led to a decline in the demand for fuel oil. However, fuel oil remains an important energy source, particularly in the industrial and residential sectors, and is expected to continue to play a role in the global energy mix in the coming years.

According to https://oec.world/ :

Fuel oils, n.e.s. are the world’s 59th most traded product.

In 1998, the top exporters of Fuel oils, n.e.s. were Singapore ($2.33B), Russia ($1.19B), Netherlands ($1.09B), Saudi Arabia ($938M), and Belgium-Luxembourg ($880M).

In 1998, the top importers of Fuel oils, n.e.s. were United States ($3.67B), Singapore ($1.78B), Italy ($1.46B), Areas ($1.45B), and China ($1.25B).

Further reading

- Wikipedia for general, history, production and usage information

- PubChem for chemistry and property information

Business Analytiq

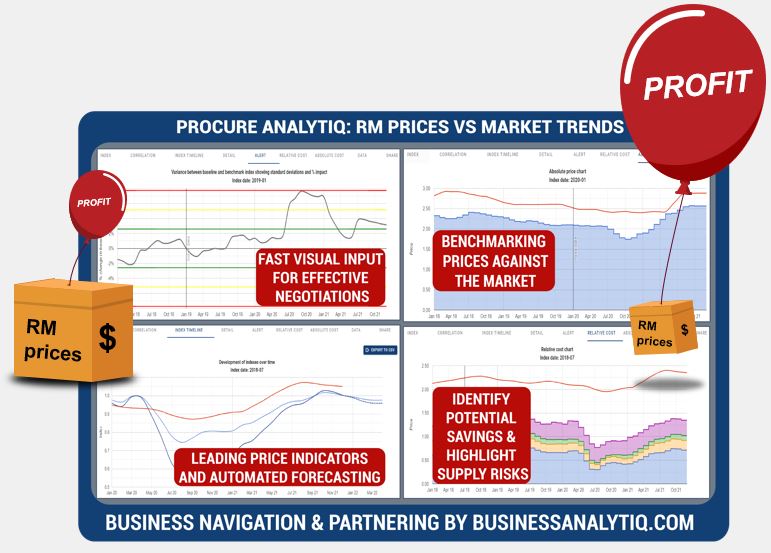

BE THE FIRST TO SEE RISK AND OPPORTUNITY!

BusinessAnalytiq provides unlimited market trend data and an online tools to track market developments, key benchmarks & leading indicators.

BusinessAnalytiq leads to price visibility, better negotiations, easier budgeting and forecasting, lower raw material prices, and improved better internal and external communication. BusinessAnalytiq will decrease risk and higher profit.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page