Iridium price February 2025 and outlook (see chart below)

- Global:US$154937.71/KG, 1.1% up

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, fitness for purpose or timeliness.

Iridium Price Index

This post is a summary of the Iridium price developments. The price developments of Iridium are expressed in US$ prices converted FX rates applicable at the time when the price was valid. Iridium price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Iridium prices is generated from different inputs including:

- Very recent price developments of immediate cost drivers of Iridium prices

- Recent price developments of underlying feedstocks which drive the price of Iridium

- Market futures for both cost drives and feedstocks of Iridium prices

- Adjustment of current supply/demand imbalances in the Iridium market

- Longer term trends in likely demand conditions

Further sources of information on the Iridium price chart

What is iridium

Iridium is a chemical element with the symbol Ir and atomic number 77. It belongs to the platinum group of elements, which also includes platinum, palladium, rhodium, ruthenium, and osmium. Iridium is a dense, lustrous, and corrosion-resistant metal. It is one of the rarest elements in the Earth’s crust and is often found in combination with platinum and other metals.

Here are some key characteristics and uses of iridium:

Density

Iridium is known for its exceptionally high density, making it one of the densest naturally occurring elements.

Corrosion Resistance

Iridium is highly resistant to corrosion and oxidation, making it useful in various industrial applications, particularly in the production of electrical contacts, spark plugs, and crucibles for high-temperature applications.

Alloys

Iridium is often alloyed with other metals, such as platinum and osmium, to enhance their properties. For example, an alloy of iridium and platinum is used in the manufacture of standard weights and measures.

Spark Plugs

Iridium is commonly used in the production of spark plugs for internal combustion engines due to its high melting point and durability.

Space Exploration

Iridium is used in certain components of spacecraft and satellites because of its resistance to extreme temperatures and radiation.

Jewelry

Iridium has been used in jewelry, typically as an alloy with platinum or other precious metals, to increase durability and resistance to wear.

Scientific Research

Iridium is used in various scientific instruments, including X-ray detectors and electrodes for analytical chemistry.

Iridium gained significant attention in the late 20th century with the development of the Iridium satellite constellation, a network of communication satellites that provide global satellite phone and data services. These satellites were named after the element due to their vast coverage of the Earth, similar to how iridium is distributed widely in the Earth’s crust.

How is Iridium produced

Iridium is primarily produced as a byproduct of platinum mining and refining. The production process for iridium involves several steps:

Mining

Iridium is found in nature in association with other platinum group metals, such as platinum, palladium, rhodium, ruthenium, and osmium. These metals are often extracted from ore deposits in regions where they are naturally occurring, such as South Africa, Russia, and Canada. The mining process typically involves the extraction of ore from underground mines.

Concentration

After mining, the ore is crushed and milled to produce a concentrate that contains a mixture of platinum group metals, including iridium.

Smelting

The concentrate is then subjected to a smelting process, where it is heated to high temperatures in a furnace. This process separates the various metals based on their different melting points. Iridium, along with the other platinum group metals, forms a metallic alloy known as “matte” during smelting.

Refining

The matte produced in the smelting process is further processed through a refining process to separate the individual platinum group metals. This is often done using a combination of chemical and physical methods, including solvent extraction and precipitation.

Solvent Extraction

Solvent extraction is a common method used to separate iridium from other platinum group metals. It involves using organic solvents to selectively extract iridium into a separate solution.

Precipitation

After solvent extraction, iridium is usually precipitated from the solution by adding chemicals that cause it to form solid iridium compounds. These compounds are then further processed to obtain pure iridium metal.

Final Refining

The final refining steps involve heating the iridium compounds to high temperatures, often in the presence of oxygen, to convert them back into pure iridium metal. This is typically done in an electric arc furnace.

Forming into Products

Once pure iridium metal is obtained, it can be formed into various products, such as wires, sheets, rods, or pellets, depending on its intended use.

It’s important to note that iridium is a relatively rare element, and its production quantities are much lower compared to more common metals like iron or copper. As a result, the production of iridium is relatively limited, and it is considered one of the rarest naturally occurring elements on Earth

What drives the cost of Iridium

The price of iridium, like many commodities and rare metals, is influenced by a combination of supply and demand factors. Several key factors that drive the price of iridium include:

Supply Constraints

Iridium is one of the rarest elements on Earth, and its production is limited. Most of the world’s iridium comes as a byproduct of platinum mining and refining. Any disruptions in the supply chain, such as labor strikes, geological challenges in mining, or geopolitical factors affecting mining regions, can impact the supply of iridium.

Demand from Industrial Applications

Iridium has several industrial applications, including its use in spark plugs, electrical contacts, high-temperature crucibles, and in the aerospace industry. The demand for these applications can vary depending on economic conditions, technological advancements, and the overall health of the industries using iridium.

Technology Advancements

Changes in technology can influence the demand for iridium. For example, advancements in fuel efficiency in automobiles may reduce the demand for iridium in spark plugs, while increased satellite communication and aerospace activities could increase demand for iridium in aerospace applications.

Currency Exchange Rates

The price of iridium is often quoted in U.S. dollars. Exchange rate fluctuations can affect the cost of iridium for buyers in other currencies. A weaker U.S. dollar can make iridium more expensive for buyers in other countries.

Investor Sentiment

As with many commodities, investor sentiment and speculative trading can influence the price of iridium. Investors may buy and sell iridium as a hedge against inflation, geopolitical uncertainty, or as part of a diversified portfolio.

Global Economic Conditions

The overall health of the global economy can impact the demand for industrial applications of iridium. During periods of economic growth, industries that use iridium may expand, leading to increased demand. Conversely, during economic downturns, demand may decrease.

Regulatory Changes

Environmental regulations or changes in trade policies can affect the production and use of iridium. Stricter regulations on emissions in the automotive industry, for example, could influence the demand for iridium in catalytic converters.

Geopolitical Factors

Political instability or trade disputes involving countries that are major producers or consumers of iridium can disrupt the supply chain and lead to price fluctuations.

Due to its limited supply and diverse industrial applications, the price of iridium can be quite volatile, and it is subject to fluctuations based on the interplay of these factors. It’s important to note that while iridium is a valuable and rare metal, its price can be influenced by a wide range of economic, technological, and geopolitical factors.

How big is the Iridium market

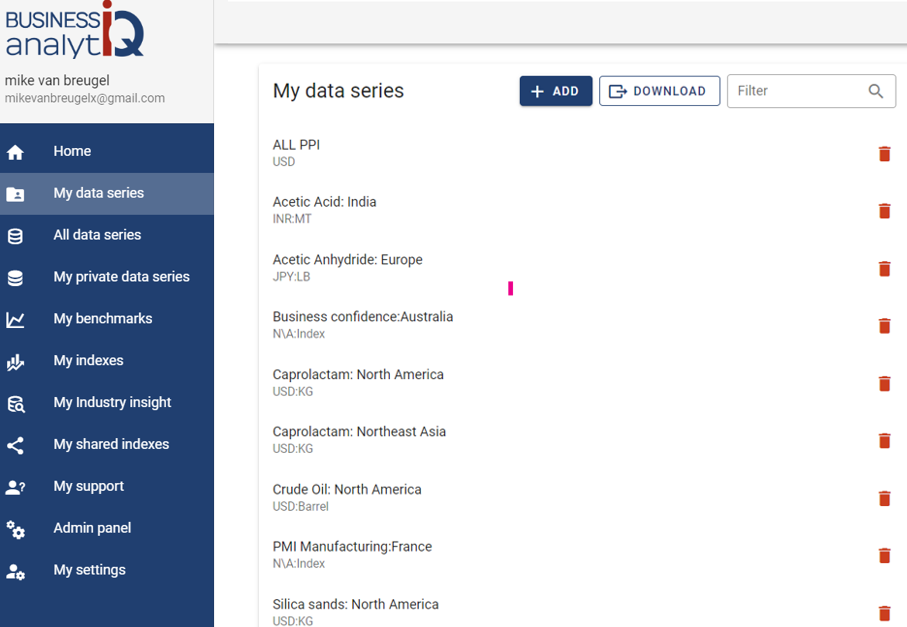

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page