Kerosene price February 2025 and outlook (see chart below)

- North America:US$0.72/KG, -2.7% down

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, fitness for purpose or timeliness.

Kerosene Price Index

This post is a summary of the Kerosene price developments. The price developments of Kerosene are expressed in US$ prices converted FX rates applicable at the time when the price was valid. Kerosene price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Kerosene prices is generated from different inputs including:

- Very recent price developments of immediate cost drivers of Kerosene prices

- Recent price developments of underlying feedstocks which drive the price of Kerosene

- Market futures for both cost drives and feedstocks of Kerosene prices

- Adjustment of current supply/demand imbalances in the Kerosene market

- Longer term trends in likely demand conditions

Further sources of information on the Kerosene price chart

What is kerosene

Kerosene is a flammable hydrocarbon liquid that is commonly used as a fuel for various purposes. It is typically derived from crude oil through a refining process known as fractional distillation. Kerosene is a clear to pale yellow liquid with a distinct odor, and it is less dense than water.

Kerosene has a range of applications, including:

Aviation

Kerosene is used as jet fuel in aircraft engines. Jet fuel is a highly refined form of kerosene specifically designed for aviation use.

Heating

Kerosene is used for heating in many homes and industrial settings. It is often used in oil furnaces and space heaters.

Lighting

Historically, kerosene lamps and lanterns were widely used for indoor and outdoor lighting before the widespread availability of electricity.

Stoves and Cooking

Kerosene stoves and cookers are still used in some parts of the world where other energy sources are less accessible.

Generator Fuel

Kerosene can be used as fuel for generators in areas with unreliable or no electricity supply.

Cleaning and Solvent

Kerosene is sometimes used as a cleaning agent and solvent in various industrial processes.

Agriculture

In some agricultural applications, kerosene is used as a fuel for certain types of machinery.

Kerosene is valued for its relatively high energy content and stability at room temperature. It is also less volatile than gasoline, making it safer for storage and transportation. The specific formulation and properties of kerosene can vary depending on its intended use, with different grades and specifications available for various applications.

How is kerosene produced

Kerosene is produced through a refining process known as fractional distillation, which is carried out at oil refineries. Here are the basic steps involved in the production of kerosene:

Crude Oil Extraction

The process begins with the extraction of crude oil from underground reservoirs or underwater wells. Crude oil is a mixture of hydrocarbons, including various grades of oil and other compounds.

Fractional Distillation

The next step is to refine the crude oil using fractional distillation. This process separates the crude oil into its various components based on their boiling points. Fractional distillation involves heating the crude oil in a tall column called a fractionating tower. The crude oil is heated at the bottom of the tower, and as it rises through the column, it cools at different levels. Different hydrocarbons condense at different temperatures, allowing for their separation.

Kerosene Separation

Kerosene is typically separated from the crude oil mixture at a specific temperature range within the fractionating tower. It usually has a boiling point between that of gasoline (which boils at lower temperatures) and diesel fuel (which boils at higher temperatures). As the vaporized crude oil rises and cools, kerosene condenses and is collected at the appropriate level in the tower.

Further Refinement

While fractional distillation separates kerosene from other hydrocarbons, additional refining processes may be required to meet specific product specifications. This can include removing impurities, adjusting the color and odor, and ensuring the kerosene meets regulatory standards for its intended use.

Storage and Distribution

Once the kerosene is separated and refined, it is stored in tanks at the refinery and then transported via pipelines, trucks, or ships to various distribution points, including gas stations, airports (for aviation kerosene), and industrial facilities.

It’s important to note that there can be different grades of kerosene produced depending on its intended use. For example, aviation kerosene (jet fuel) undergoes further refinement to meet stringent requirements for use in aircraft engines.

Overall, the production of kerosene is an essential part of the petroleum refining process, and it involves separating and purifying the appropriate range of hydrocarbons from crude oil.

What drives the cost of Kerosene

The cost of kerosene is influenced by various factors, both supply-side and demand-side, that can vary over time and by region. Here are some of the key drivers that can affect the price of kerosene:

Crude Oil Prices

Kerosene is derived from crude oil, so one of the most significant factors affecting its cost is the price of crude oil in the global market. When crude oil prices rise, it tends to lead to higher kerosene prices as well.

Refining Costs

The cost of refining crude oil into kerosene also impacts its price. Refineries have operational and maintenance costs that can fluctuate based on factors such as energy costs, labor costs, and the complexity of the refining process.

Transportation and Distribution Costs

The cost of transporting kerosene from refineries to distribution points and then to end consumers can be a significant factor. Factors such as fuel prices, transportation infrastructure, and distance can influence these costs.

Taxes and Duties

Governments often levy taxes and duties on kerosene, which can vary by country and region. These taxes can significantly impact the final price paid by consumers.

Exchange Rates

Since crude oil is often traded in U.S. dollars, exchange rate fluctuations can affect the cost of kerosene in countries with different currencies. A weaker local currency can make imported kerosene more expensive.

Seasonal Demand

In some regions, the demand for kerosene can vary seasonally. For example, it may be used for heating in the winter months, leading to higher prices during that time.

Geopolitical Factors

Political instability or conflicts in oil-producing regions can disrupt the supply of crude oil and lead to price spikes in the global oil market, affecting kerosene prices.

Environmental Regulations

Environmental regulations and standards can also affect the price of kerosene. Refineries may need to invest in technology to meet emissions requirements, which can increase production costs.

Competition

In regions with multiple suppliers and competitive markets, kerosene prices may be lower due to competition among retailers and distributors.

Subsidies

Some governments may provide subsidies to keep kerosene prices affordable for consumers, which can reduce the market price. Conversely, the removal of subsidies can lead to higher prices.

Global Events

Unforeseen events, such as natural disasters or geopolitical crises, can disrupt the supply chain and lead to temporary price increases.

It’s important to note that the relative importance of these factors can vary depending on the region and the specific market conditions. Additionally, kerosene prices can be subject to frequent fluctuations due to the dynamic nature of the global oil market.

How big is the Kerosene market

Jet Kerosene Market was valued at US$ 440 Bn. in 2022. The global Jet Kerosene Market size is estimated to grow at a CAGR of 4%.

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

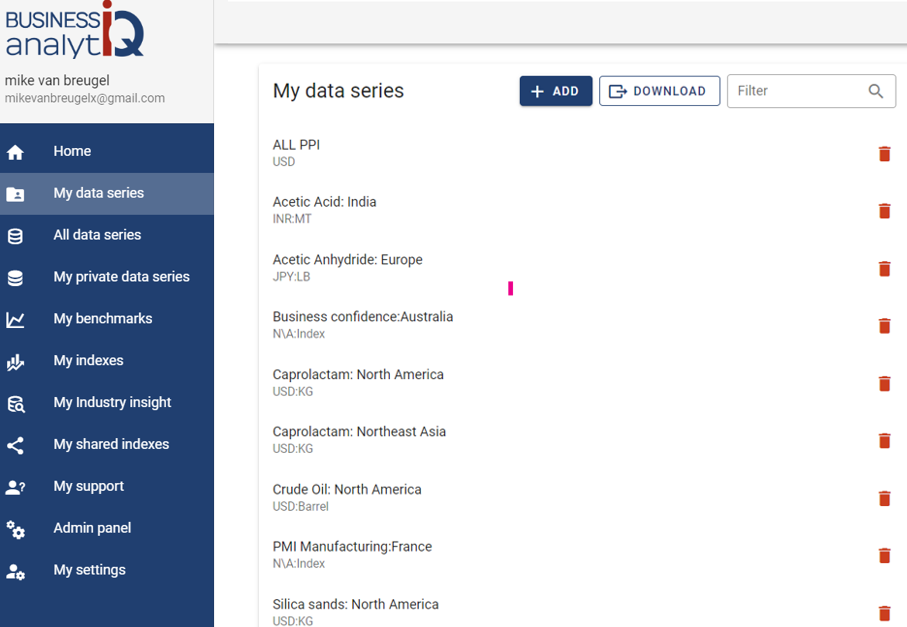

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page