Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness.

Molybdenum price index

This post is a summary of the Molybdenum price index developments since 2005 as per the IMF. The developments are expressed as an index and not in absolute terms. Therefore the Molybdenum price index means that the values provided are relative to Jan 1 2019 which is defined as 1.00.

Further information on the Molybdenum price chart

What is Molybdenum

Molybdenum is a chemical element with the symbol Mo and atomic number 42. It is a silvery-white metal with a high melting point of 2,623 °C (4,753 °F), making it one of the refractory metals. Molybdenum is an important element in modern technology, used in a wide range of industrial and scientific applications.

Molybdenum is commonly used as an alloying agent in steel and other metals, as it improves their strength, toughness, and resistance to corrosion and wear. It is also used in the production of various industrial catalysts, such as those used in the petroleum industry.

In addition, molybdenum is an essential trace element for humans, as it is involved in several important biological processes. It is a cofactor for various enzymes, including those involved in the metabolism of sulfur-containing amino acids, DNA synthesis, and nitrogen fixation in plants.

Molybdenum is found in various minerals, including molybdenite, wulfenite, and powellite. It is also present in small amounts in many foods, including meats, dairy products, and grains.

How is Molybdenum produced

Molybdenum is typically produced from its ores, which are found in various parts of the world. The most common molybdenum mineral is molybdenite (MoS2), which is a sulfide mineral that can be found in large deposits.

The production of molybdenum involves several steps, including mining, beneficiation, roasting, and smelting. Here is a brief overview of the process:

Mining

Molybdenum is typically extracted from open-pit or underground mines using conventional mining techniques. The ore is then crushed and milled to produce a fine powder.

Beneficiation

The molybdenum powder is then processed through a series of steps to remove impurities and concentrate the molybdenum content. This may involve flotation, leaching, or other separation techniques.

Roasting

The molybdenum concentrate is then roasted in a furnace to convert the molybdenum sulfide to molybdenum oxide. The roasting process involves heating the concentrate to high temperatures in the presence of oxygen.

Smelting

The molybdenum oxide is then reduced to metal in a smelter using a process called carbothermic reduction. This involves heating the oxide in the presence of carbon to produce a molten metal, which is then cast into ingots or other shapes.

Refining

The molybdenum metal may then be further purified using techniques such as vacuum distillation or electro-refining.

The final product is high-purity molybdenum metal or molybdenum alloys, which are used in various industrial applications, such as steel production, catalysts, and electronic components.

What drives the cost of Molybdenum

The cost of molybdenum can be influenced by several factors, including supply and demand, production costs, and market speculation. Here are some of the key drivers of molybdenum prices:

Industrial demand

Molybdenum is an important metal in the production of steel, as it improves the strength and corrosion resistance of steel alloys. Therefore, any changes in demand for steel can have an impact on the demand for molybdenum.

Currency fluctuations

The price of molybdenum can also be influenced by fluctuations in currency exchange rates, as molybdenum is traded in US dollars on global markets.

Market speculation

Like other commodities, molybdenum prices can be influenced by market speculation and investor sentiment. Changes in market sentiment can cause fluctuations in molybdenum prices, even if there are no significant changes in supply or demand.

Production costs

The cost of producing molybdenum can also impact its price. The production of molybdenum requires significant energy inputs, as well as other resources such as water and labor. Therefore, changes in production costs can affect the profitability of molybdenum producers, which can in turn affect the price of molybdenum.

What is Molybdenum used for

Molybdenum is used in a variety of industrial and technological applications, due to its unique properties. Here are some of the most common uses of molybdenum:

Alloying agent in steel

Molybdenum is commonly used as an alloying element in steel to improve its strength, toughness, and corrosion resistance. Steel containing molybdenum is used in a wide range of applications, including construction, transportation, and machinery.

Electrical and electronic components

Molybdenum is used in the production of electrical contacts, filaments, and other components due to its high melting point and good electrical conductivity.

Catalysts

Molybdenum compounds are used as catalysts in various chemical processes, such as the production of chemicals, refining of petroleum, and treatment of wastewater.

Aerospace and defense

Molybdenum is used in various applications in the aerospace and defense industries, due to its high strength and heat resistance. It is used in missile and aircraft parts, as well as in nuclear weapons.

Medical applications

Molybdenum is used in some medical applications, such as in bone scans, due to its ability to absorb X-rays.

Glass and ceramics

Molybdenum is used in the production of glass and ceramics, as it can improve their durability and heat resistance.

Lubricants

Molybdenum disulfide is used as a solid lubricant due to its low friction coefficient and high resistance to wear.

Overall, molybdenum is a versatile metal that has many applications in modern technology and industry.

What are specific properties of Molybdenum

Molybdenum is a unique metal that possesses a number of properties that make it useful for a variety of industrial and technological applications. Here are some of the key properties of molybdenum:

High melting point

Molybdenum has a very high melting point of 2,623 °C (4,753 °F), which makes it useful in high-temperature applications.

Good electrical conductivity

Molybdenum is a good conductor of electricity, making it useful in electrical and electronic applications.

High strength and stiffness

Molybdenum has a high strength-to-weight ratio, which makes it useful in structural applications where strength and stiffness are important.

Corrosion resistance

Molybdenum has good corrosion resistance, particularly in acidic environments.

High thermal conductivity

Molybdenum has a high thermal conductivity, which makes it useful in applications where heat needs to be dissipated quickly.

Low coefficient of thermal expansion

Molybdenum has a very low coefficient of thermal expansion, which means it does not expand or contract significantly with changes in temperature. This makes it useful in applications where dimensional stability is important.

Good wear resistance

Molybdenum is very resistant to wear and abrasion, which makes it useful in applications where parts are subject to high stress and wear.

Overall, the combination of these properties makes molybdenum a valuable material in a wide range of industrial and technological applications.

What types of Molybdenum are there

Molybdenum is available in several different forms, each of which is optimized for specific applications. Here are some of the most common types of molybdenum:

Molybdenum metal

This is the most common form of molybdenum, which is used in a wide range of applications. It is usually produced by reduction of molybdenum trioxide with hydrogen.

Molybdenum alloys

Molybdenum is often alloyed with other metals to improve their mechanical properties. Common alloying elements include tungsten, titanium, and niobium.

Molybdenum powder

Molybdenum powder is used as a raw material in the production of various molybdenum products.

Molybdenum disulfide

This is a compound made of molybdenum and sulfur, which has a low coefficient of friction and is often used as a solid lubricant.

Molybdenum trioxide

This compound is used in the production of molybdenum metal and alloys, as well as in the manufacture of ceramics, pigments, and flame retardants.

Ammonium molybdate

This is a white, crystalline powder used as a source of molybdenum in a wide range of industrial applications.

Each of these forms of molybdenum has its own unique properties and applications, making molybdenum a versatile metal that is used in many different industries.

Which countries produce the most Molybdenum

China is the world’s largest producer of molybdenum, accounting for about 40-45% of global production. Other major producers of molybdenum include the United States, Chile, Peru, and Canada.

The United States is the world’s second-largest producer of molybdenum, with most of its production coming from the states of Colorado, Arizona, and Idaho. Chile is the world’s third-largest producer, with most of its production coming from the Chuquicamata and Collahuasi mines. Peru and Canada are also significant producers of molybdenum, with most of their production coming from the mines in the Andes Mountains.

There are also several other countries that produce smaller amounts of molybdenum, including Mexico, Russia, Mongolia, and Australia. The exact distribution of global molybdenum production can vary from year to year depending on a variety of factors, including global demand for the metal and the prices of molybdenum on the international market.

How big is the global Molybdenum market

The global molybdenum market is a significant segment of the metals and minerals industry, and it is valued at several billion US dollars. The exact size of the market can vary from year to year depending on factors such as global demand for molybdenum and the prices of the metal, but in recent years, the global market for molybdenum has been estimated to be around $5-6 billion.

China is the largest producer and consumer of molybdenum, and it has a dominant share of the global market. Other major producers of molybdenum include the United States, Chile, and Peru. The market for molybdenum is driven by demand from a variety of industries, including construction, automotive, aerospace, energy, and electronics.

Overall, the global molybdenum market is expected to continue growing in the coming years, driven by increasing demand for the metal in a wide range of industrial applications.

According to https://oec.world/:

Molybdenum are the world’s 979th most traded product.

In 2020, the top exporters of Molybdenum were China ($149M), Austria ($128M), Japan ($47.4M), United States ($45.9M), and Germany ($44.1M).

In 2020, the top importers of Molybdenum were United States ($74M), Germany ($68.8M), Chinese Taipei ($53.8M), South Korea ($52.9M), and China ($46.3M).

Further information

Data source: IMF

This data has been partly provided by the IMF and the World Bank. The only change is that it has been indexed for Jan 2019 (so Jan 2019 is set as the index 1.00). The data is provided subject to the terms and conditions as defined by the IMF

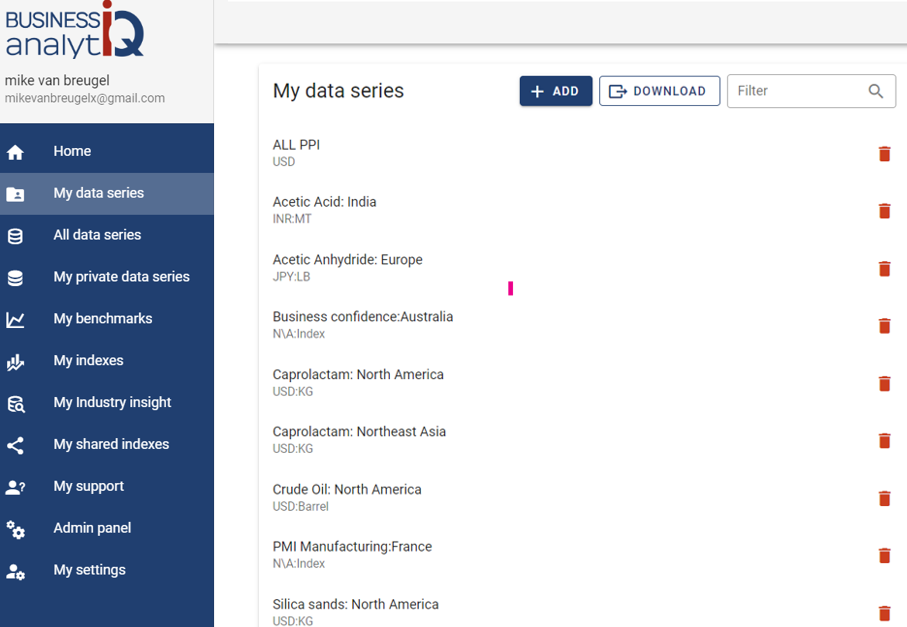

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page