Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, fitness for purpose or timeliness.

Crude oil price index

This post is a summary of the Crude Oil acid price developments. The price developments of Crude Oil are expressed in US$ prices converted FX rates applicable at the time when the price was valid. Crude Oil price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Crude Oil prices, on the second tab, is generated from different inputs including:

- Very recent price developments of immediate cost drivers of Crude Oil prices

- Recent price developments of underlying feedstocks which drive the price of Crude Oil

- Market futures for both cost drives and feedstocks of Crude Oil prices

- Adjustment of current supply/demand imbalances in the Crude Oil market

- Longer term trends in likely demand conditions

Further information on the Oil price index

What is crude oil

Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. It is a fossil fuel that is extracted from the ground through the process of drilling. Crude oil is a dark, viscous liquid that is usually found in underground rock formations and can be extracted through a variety of methods, including traditional drilling and hydraulic fracturing (also known as “fracking”). It is a primary source of energy and is used to produce a variety of products, including gasoline, diesel fuel, and various types of plastics. Crude oil is also a major commodity that is traded on the global market, with prices often fluctuating due to a variety of factors, including supply and demand, geopolitical events, and economic conditions.

How is crude oil produced

Crude oil is produced through a process called oil drilling, which involves the use of specialized drilling rigs to bore deep into the earth to access oil deposits. The drilling process begins by creating a hole in the ground, called a wellbore, using a drilling rig. The drilling rig consists of a series of interconnected pipes, known as casing, which are lowered into the wellbore. As the drilling rig descends deeper into the ground, the casing is used to keep the wellbore stable and prevent it from collapsing.

Once the drilling rig reaches the oil deposit, a series of pumps and valves are used to bring the crude oil to the surface. The crude oil is then transported to a refinery, where it is processed and refined into various products, such as gasoline, diesel fuel, and various types of plastics.

There are several different methods for extracting crude oil, including traditional drilling, hydraulic fracturing, and offshore drilling. Traditional drilling involves the use of a drilling rig to access oil deposits that are located deep underground. Hydraulic fracturing, or “fracking,” is a technique that involves injecting a mixture of water, sand, and chemicals into the ground to create fractures in the rock and allow oil and natural gas to flow more easily. Offshore drilling is the process of extracting oil and natural gas from the ocean floor, typically using a drilling rig located on a platform in the ocean.

What is crude oil used for

Crude oil is a versatile fossil fuel that is used to produce a wide range of products, including gasoline, diesel fuel, aviation fuel, and various types of plastics. It is also used as a raw material in the production of chemicals, such as fertilizers and detergents.

Gasoline is a liquid hydrocarbon that is used as a fuel for internal combustion engines, such as those found in automobiles and other vehicles. It is typically made from crude oil and is refined through a process called distillation, which separates the various hydrocarbons in the oil based on their boiling points.

Diesel fuel is another liquid hydrocarbon that is used as a fuel for internal combustion engines, typically in trucks, buses, and other heavy-duty vehicles. It is also made from crude oil and is refined through a process similar to gasoline.

Aviation fuel is a type of fuel that is used to power aircraft. It is typically made from crude oil and is refined to meet specific performance and safety requirements.

Plastics are a wide variety of synthetic or semi-synthetic materials that are made from petrochemicals, which are derived from crude oil and natural gas. Plastics are used in a variety of applications, including packaging, construction, and automotive manufacturing.

Crude oil is also used as a raw material in the production of a variety of chemicals, including fertilizers and detergents. Fertilizers are substances that are applied to soil to provide nutrients that help plants grow, while detergents are used for cleaning and removing dirt and stains.

Further reading

Crude oil market size

The global crude oil market is vast and dynamic, with billions of barrels of oil being produced, transported, and consumed every year. According to data from the International Energy Agency (IEA), global oil demand was approximately 101 million barrels per day in 2020, with the majority of this demand coming from the transportation sector. The largest crude oil producers in the world include the United States, Russia, Saudi Arabia, and Iraq, while the largest consumers are China, the United States, and India.

The crude oil market is also highly influenced by a variety of factors, including geopolitical tensions, economic conditions, technological advances, and environmental concerns. Prices for crude oil can fluctuate significantly based on these and other factors, and the market is subject to regular fluctuations and price volatility.

According to https://oec.world/ : Petroleum oils, oils from bituminous minerals, crude are the world’s 1st most traded product.

In 2020, the top exporters of Petroleum oils, oils from bituminous minerals, crude were Saudi Arabia ($95.7B), Russia ($74.4B), United States ($52.3B), Canada ($47.2B), and Iraq ($45.2B).

In 2020, the top importers of Petroleum oils, oils from bituminous minerals, crude were China ($150B), United States ($75.1B), India ($59B), South Korea ($42.2B), and Japan ($38.4B).

Data source: IMF

This data has been partly provided by the IMF and the World Bank. The only change is that it has been indexed for Jan 2019 (so Jan 2019 is set as the index 1.00). The data is provided subject to the terms and conditions as defined by the IMF

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

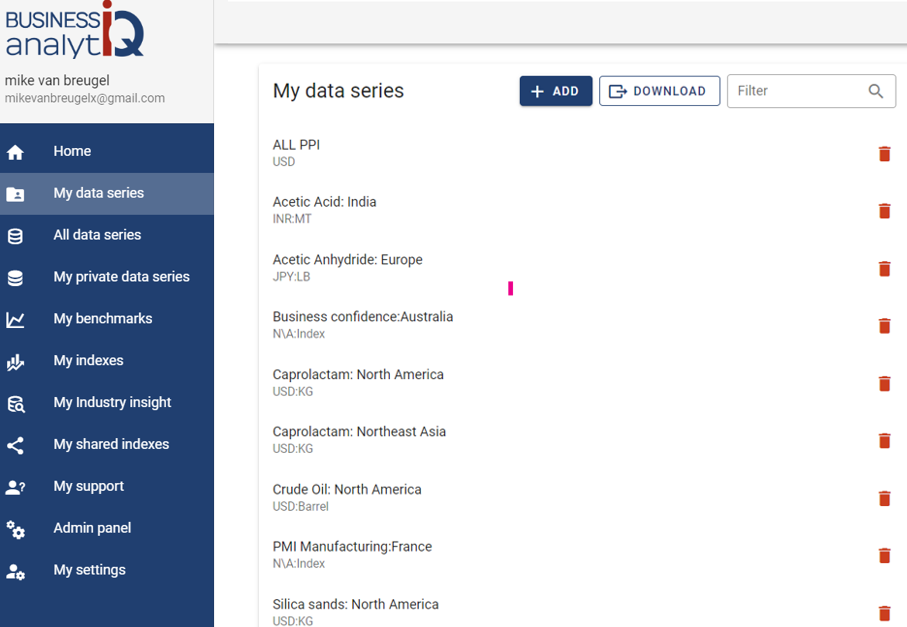

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page