Ruthenium price April 2024 and outlook (see chart below)

- Global:US$15525.78/KG, -2.7% down

Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, fitness for purpose or timeliness.

Ruthenium Price Index

This post is a summary of the Ruthenium price developments. The price developments of Ruthenium are expressed in US$ prices converted FX rates applicable at the time when the price was valid. Ruthenium price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Ruthenium prices is generated from different inputs including:

- Very recent price developments of immediate cost drivers of Ruthenium prices

- Recent price developments of underlying feedstocks which drive the price of Ruthenium

- Market futures for both cost drives and feedstocks of Ruthenium prices

- Adjustment of current supply/demand imbalances in the Ruthenium market

- Longer term trends in likely demand conditions

Further sources of information on the Ruthenium price chart

What is Ruthenium

Ruthenium is a chemical element with the symbol “Ru” and atomic number 44. It is a rare transition metal that belongs to the platinum group of elements, which also includes platinum, palladium, rhodium, iridium, and osmium. Ruthenium is known for several notable properties and uses:

Physical Characteristics

Ruthenium is a hard, silvery-white metal with a high melting point and excellent corrosion resistance. It is one of the densest elements in the periodic table.

Industrial and Scientific Applications

Ruthenium has a range of industrial and scientific applications. It is used as a catalyst in various chemical reactions, including in the production of ammonia and in organic synthesis. Ruthenium-based catalysts are known for their efficiency and selectivity.

Electrical Contacts

Ruthenium is used in electrical contacts and switches due to its high melting point and resistance to wear and corrosion. It is often alloyed with other metals like platinum or palladium for this purpose.

Electronics

In the electronics industry, ruthenium is used in the production of thin-film resistors, which are crucial components in electronic circuits.

Solar Energy

Ruthenium compounds have been studied for their potential use in dye-sensitized solar cells, which are a type of solar cell that can convert sunlight into electricity.

Alloys

Ruthenium is sometimes alloyed with other metals to improve their properties. For example, it can be added to platinum to enhance its hardness and resistance to wear.

Research and Scientific Studies

Ruthenium compounds have applications in scientific research, including X-ray spectroscopy, nuclear magnetic resonance (NMR) studies, and the development of new materials.

Jewelry

Although less common than other precious metals like gold and platinum, ruthenium has been used in jewelry, typically as a plating material to give jewelry a unique and dark appearance.

Ruthenium is relatively rare in the Earth’s crust, and its production is limited. It is often obtained as a byproduct of platinum and nickel mining and refining. Due to its unique properties and the relatively small quantities in which it is produced, ruthenium can be relatively expensive compared to more common metals. Its applications in catalysis, electronics, and materials science make it an important element in various high-tech and industrial sectors

How is Ruthenium produced

Ruthenium is primarily produced as a byproduct of platinum and nickel mining and refining. The production process for ruthenium involves several steps, and it is often found in the form of a mixture with other platinum group metals. Here’s an overview of how ruthenium is produced:

Mining

Ruthenium is typically found in nature in association with other platinum group metals, such as platinum, palladium, and rhodium. These metals are often extracted from ore deposits in regions where they are naturally occurring, such as South Africa, Russia, and Canada. The mining process involves the extraction of ore from underground mines.

Concentration

After mining, the ore is crushed and milled to produce a concentrate that contains a mixture of platinum group metals, including ruthenium.

Smelting

The concentrate is subjected to a smelting process, where it is heated to high temperatures in a furnace. This process separates the various metals based on their different melting points. During smelting, a metallic alloy known as “matte” is formed, which contains a combination of platinum group metals, including ruthenium.

Refining

The matte produced in the smelting process is further processed through a refining process to separate the individual platinum group metals. This is often done using a combination of chemical and physical methods, including solvent extraction and precipitation.

Solvent Extraction

Solvent extraction is a common method used to separate ruthenium from other platinum group metals. It involves using organic solvents to selectively extract ruthenium into a separate solution.

Precipitation

After solvent extraction, ruthenium is usually precipitated from the solution by adding chemicals that cause it to form solid ruthenium compounds. These compounds are then further processed to obtain pure ruthenium metal.

Final Refining

The final refining steps involve heating the ruthenium compounds to high temperatures, often in the presence of oxygen, to convert them back into pure ruthenium metal. This is typically done in an electric arc furnace.

Forming into Products

Once pure ruthenium metal is obtained, it can be formed into various products, such as bars, sheets, and other shapes, depending on its intended use.

It’s important to note that ruthenium is a relatively rare and valuable metal, and its production quantities are much lower compared to more common metals like iron or copper. The production of ruthenium is closely tied to the demand for other platinum group metals, and its supply can be influenced by factors such as mining conditions, geopolitical factors, and fluctuations in demand from various industries. As a result, the price of ruthenium can be highly volatile.

What drives the cost of ruthenium

The cost of ruthenium is influenced by a combination of supply and demand factors, as well as market dynamics specific to this rare and valuable metal. Several key factors that drive the cost of ruthenium include:

Supply Constraints

Ruthenium is one of the rarest elements on Earth, and its production is inherently limited. Most ruthenium is produced as a byproduct of platinum and nickel mining and refining. Any disruptions in the supply chain, such as labor strikes, geological challenges in mining, or geopolitical factors affecting mining regions, can impact the supply of ruthenium.

Demand from Industrial Applications

Ruthenium has a range of industrial applications, including its use as a catalyst in various chemical reactions, in the electronics industry for thin-film resistors, and in the production of certain specialized materials. Fluctuations in demand from these applications can significantly influence the cost of ruthenium.

Catalysis

Ruthenium is a crucial catalyst in several chemical processes, including those used in the production of ammonia, pharmaceuticals, and fine chemicals. Changes in demand for these products or shifts in industrial production can affect the demand for ruthenium catalysts.

Electronics

The electronics industry uses ruthenium in the production of thin-film resistors and other components. The demand for ruthenium in electronics can vary based on technological advancements and shifts in consumer demand for electronic devices.

Investor Sentiment

Similar to other precious metals, investor sentiment and speculative trading can influence the price of ruthenium. Investors may buy and sell ruthenium as a hedge against inflation, economic uncertainty, or as part of a diversified investment portfolio.

Currency Exchange Rates

The price of ruthenium is often quoted in U.S. dollars. Exchange rate fluctuations can affect the cost of ruthenium for buyers in other currencies. A weaker U.S. dollar can make ruthenium more expensive for buyers in other countries.

Recycling

Recycling of ruthenium from end-of-life products, such as catalytic converters and electronics, can contribute to the supply of ruthenium. Recycling rates can be influenced by economic incentives and the availability of recycling technologies.

Geopolitical Factors

Political instability or trade disputes involving countries that are major producers or consumers of ruthenium can disrupt the supply chain and lead to price fluctuations.

Due to its limited natural abundance and unique properties, the price of ruthenium can be highly volatile and subject to rapid fluctuations based on changes in supply and demand dynamics. It’s important to note that market conditions and external factors can evolve over time, so the cost of ruthenium may vary from one period to another. For up-to-date information on the cost of ruthenium, it is advisable to refer to commodities market sources and industry reports.

How big is the ruthenium market

The ruthenium market is relatively small compared to other precious metals and commodities due to the rarity of ruthenium in the Earth’s crust and its limited industrial applications.

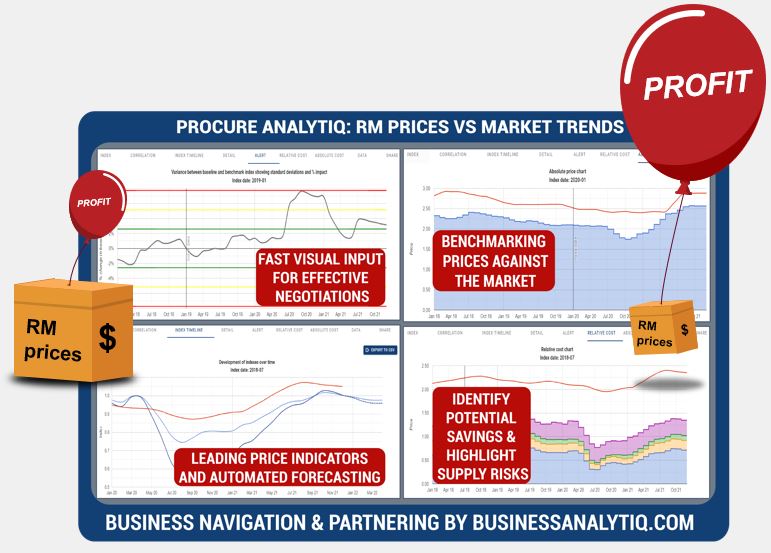

Business Analytiq

BE THE FIRST TO SEE RISK AND OPPORTUNITY!

BusinessAnalytiq provides unlimited market trend data and an online tools to track market developments, key benchmarks & leading indicators.

BusinessAnalytiq leads to price visibility, better negotiations, easier budgeting and forecasting, lower raw material prices, and improved better internal and external communication. BusinessAnalytiq will decrease risk and higher profit.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page