Business Analytiq assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness.

Sea fright container price index

This post is a summary of the Sea freight price developments. The price developments of Sea freight are expressed in US$ prices per full container load. Sea freight price index developments are calculated from multiple separate sources of data to ensure statistical accuracy.

The outlook for Sea freight prices are generated from different inputs including:

- Very recent price developments of immediate cost drivers of Sea freight

- Recent price developments of underlying feedstocks which drive the price of Sea freight

- Market futures for both cost drives and feedstocks of Sea freight prices

- Adjustment of current supply/demand imbalances in the Sea freight market

- Longer term trends in likely demand conditions

Further information on the Sea freight price index

What is sea freight container price index

The sea freight container price index is a metric that tracks the fluctuations in the cost of shipping goods via container ships over time.

This index provides valuable insights into the maritime shipping industry’s dynamics, reflecting changes in transportation costs influenced by various factors such as supply and demand, fuel prices, economic conditions, and geopolitical events.

Key Components and Features

Measurement of Shipping Costs

The index typically measures the cost to transport a standard 40-foot container. between specific ports or regions. This standardization allows for consistent comparison over time and across different shipping routes.

Benchmarking Tool

Businesses involved in international trade use the index to benchmark shipping costs, negotiate contracts with carriers, and make informed logistical decisions.

How are sea freight container prices set?

Factors Influencing the Sea Freight Container Price Index

Supply and Demand

High demand for shipping services or limited availability of shipping capacity can drive up prices. Conversely, excess capacity or reduced demand can lower rates.

Fuel Prices

Fuel is a significant operational cost for shipping companies. Fluctuations in oil prices directly impact container shipping rates.

Economic Conditions

Global economic growth increases trade volumes, boosting demand for shipping services and potentially raising prices. Economic downturns have the opposite effect.

Port Congestion and Infrastructure

Delays and inefficiencies at major ports can reduce shipping capacity and increase costs due to longer transit times and higher handling fees.

Geopolitical Events

Conflicts, trade wars, sanctions, and changes in trade policies can disrupt shipping routes and supply chains, affecting freight rates.

Seasonality

Certain times of the year, such as the lead-up to major holidays, experience increased shipping demand, influencing prices.

Regulatory Changes

New environmental regulations or changes in shipping laws can affect operational costs for shipping companies, impacting container prices.

Technological Advancements

Innovations that improve shipping efficiency or reduce costs can influence freight rates positively or negatively.

How to use container freight indexes?

Cost Management

Businesses involved in importing and exporting use the index to manage and forecast shipping costs, aiding in budgeting and financial planning.

Contract Negotiation

Companies leverage index trends to negotiate better shipping contracts with carriers or seek alternative routes and methods to optimize costs.

Economic Indicators

Analysts and economists use the index as a leading indicator of global trade activity and economic health, as shipping volumes often correlate with economic performance.

Investment Decisions

Investors and stakeholders in the shipping industry monitor the index to make informed investment decisions based on market trends.

Supply Chain Optimization

Understanding freight trends helps companies optimize their supply chains, potentially adjusting sourcing or distribution strategies to minimize costs.

How big is the Sea freight market

The global freight container market is a pivotal component of international trade and the global economy. It encompasses the transportation of goods in standardized containers (typically 20-foot Equivalent Units or TEUs) across various shipping routes worldwide. Understanding the size and dynamics of this market provides insights into global trade patterns, economic health, and logistical efficiencies.

Market Size and Value

As of the latest available data up to 2023, the global freight container market is substantial:

Market Value: The container shipping industry was valued at approximately $250 billion to $300 billion in 2022. Projections anticipated growth to around $350 billion by 2027, reflecting a compound annual growth rate (CAGR) of about 4-5%.

Container Throughput: Global container throughput was estimated at over 800 million TEUs annually. The market has seen a steady increase in TEUs over the past decade, driven by globalization and the expansion of international trade.

Key Segments

The container market can be segmented based on:

Container Types:

Standard Containers (Dry Vans): The most common, used for a wide variety of goods.

Refrigerated Containers (Reefers): For perishable goods.

Specialized Containers: Including tank containers, open-top, and flat-rack containers.

Regional Markets:

Asia-Pacific: Dominates the market, with China being the largest exporter and a key hub.

Europe: Significant importer and exporter, with major ports like Rotterdam and Hamburg.

North America: Major ports include Los Angeles, Long Beach, and New York/New Jersey.

Other Regions: Middle East, Africa, and Latin America are growing markets.

Major Players

The container shipping industry is characterized by a few large conglomerates that dominate global shipping:

Maersk Line: The largest container shipping company globally, based in Denmark, with a fleet of over 700 vessels.

Mediterranean Shipping Company (MSC): A close competitor to Maersk, headquartered in Switzerland.

CMA CGM Group: Based in France, one of the top three global container shipping companies.

COSCO Shipping Lines: A major Chinese shipping company with extensive global reach.

Hapag-Lloyd: Based in Germany, another leading global container carrier.

These companies control a significant share of the market, often engaging in alliances to optimize route networks and capacity.

Market Drivers

Several factors drive the growth and size of the global freight container market:

Global Trade Growth: Expansion of international trade, especially between emerging economies and developed markets, increases demand for container shipping.

E-commerce Boom: The rise of e-commerce has led to higher volumes of small, frequent shipments, benefiting container shipping.

Economic Development: Growth in manufacturing and consumer markets, particularly in Asia, drives container demand.

Infrastructure Investments: Development of major ports and logistics hubs enhances shipping efficiency and capacity.

Technological Advancements: Innovations in shipping technology, such as larger container ships and improved logistics management, contribute to market growth.

5. Regional Insights

Asia-Pacific: The region handles the majority of global container traffic, with China acting as the central hub for exports and imports. Key ports include Shanghai, Singapore, and Hong Kong.

Europe: Europe serves as a major transit and distribution center, with significant imports from Asia and exports to the Americas and Africa. Rotterdam is the largest port in Europe.

North America: The West Coast (e.g., Los Angeles, Long Beach) is the primary gateway for Asian imports, while the East Coast (e.g., New York, Savannah) handles significant transatlantic trade.

Middle East and Africa: Emerging as important routes due to increasing trade activities and investments in port infrastructure.

Trends and Future Outlook

Sustainability Initiatives: The industry is moving towards greener shipping practices, including the adoption of alternative fuels and more energy-efficient vessels to reduce carbon emissions.

Digitalization: Enhanced use of digital platforms for tracking, logistics management, and improving supply chain transparency.

Consolidation: Ongoing mergers and acquisitions among shipping lines to achieve economies of scale and expand service networks.

Supply Chain Resilience: In response to disruptions like the COVID-19 pandemic, there is a focus on building more resilient and flexible supply chains.

Capacity Adjustments: Balancing fleet capacity with demand to prevent overcapacity and stabilize freight rates.

Challenges

Volatility in Freight Rates: Fluctuations due to supply-demand imbalances, fuel price changes, and geopolitical tensions.

Regulatory Compliance: Adhering to international regulations regarding emissions, safety, and trade policies can increase operational costs.

Port Congestion: Delays and inefficiencies at major ports can disrupt shipping schedules and increase costs.

Key Statistics (As of 2023)

Global Fleet Capacity: Approximately 23,000 to 25,000 container ships, totaling over 20 million TEUs in global capacity.

Annual Growth Rate: The container shipping market has been growing at a CAGR of around 4-5% over the past five years, with projections to continue this trend barring significant economic downturns.

Major Trade Routes: Asia-Europe, Asia-North America, and intra-Asia routes account for the highest volumes of container traffic.

Impact of Geopolitical and Economic Factors

Trade Agreements and Tariffs: Changes in trade policies, such as tariffs or free trade agreements, can significantly impact shipping volumes and routes.

Economic Cycles: Economic booms lead to increased shipping demand, while recessions can cause sharp declines in container volumes.

Pandemic Recovery: The industry has been recovering from disruptions caused by the COVID-19 pandemic, though challenges like container shortages and port delays have persisted.

Sources for Further Information

For the most accurate and up-to-date information on the global freight container market, consider consulting the following sources:

UNCTAD Review of Maritime Transport: Provides comprehensive data and analysis on global shipping trends.

International Maritime Organization (IMO): Offers insights into regulatory changes and their impact on shipping.

Clarksons Research: A leading provider of shipping intelligence and market data.

Drewry Shipping Consultants: Publishes regular reports and forecasts on container shipping.

Industry Associations: Organizations like the International Chamber of Shipping (ICS) and the World Shipping Council (WSC) provide valuable resources and statistics.

Summary

The global freight container market is a dynamic and essential component of international trade, characterized by significant size, steady growth, and complex interdependencies with economic and geopolitical factors. As global trade continues to evolve, the container shipping industry adapts through technological advancements, sustainability initiatives, and strategic collaborations among major players. Staying informed about market trends and challenges is crucial for businesses, investors, and policymakers engaged in or affected by global trade and logistics.

NEED A QUICK DOWNLOAD?

ACCESS TO OUR FULL DATABASE IS US$399/YEAR, WITH A 30-DAY $30 TRIAL

GET THAT DOWNLOAD IN 3 MINUTES!

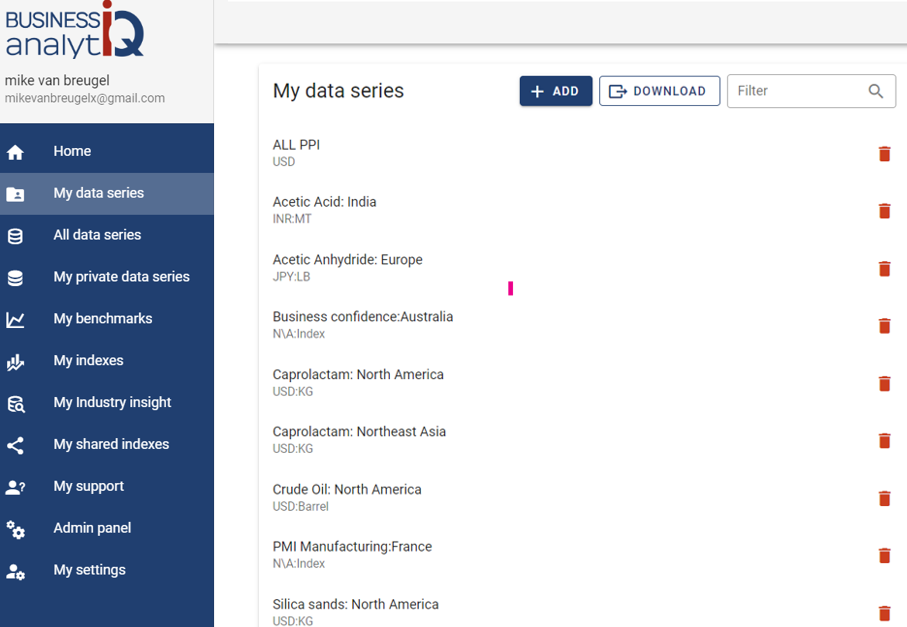

BusinessAnalytiq provides a database of hundreds of market & price trend data, as well as online tools to set up benchmarks and leading indicators.

Where does the data come from?

- The source of the data are exclusively public non-confidential sources. We have no access to primary data

- This the index trend of the price trend of the "product category" in general, and not a single specification of the product in particular

- The data is a combination of contract and spot pricing

- Our algorithms are set up to eliminate significant product mix impact on the reported price

- We combine public publications, import/export records, trading prices, company announcements, magazine articles, tweets, and other sources of ad-hoc public information.

- The chart shows the our best approximation of the market trend based on our algorithm interpretation of the signals

- For most indexes we have multiple sources and we focus on using statistically-correlated sources

- As a function of our automation, it is likely that recent trends will be adjusted as we discover more information. So, for example, the price trend for February 2024 will be first calculated in February 2024 and adjusted in March, April and May 2024.

- We will update the data trend as more information becomes available, and this means that recent trends will always be adjusted as we get more data available

- The algorithm will regularly revise our understanding of market trends, and indicated market trends may change

- The data is presented in US$. The UOM of measure is shown in the Index list table

- Our automated software and we do our best to create an accurate representation of the trend

Where does the data NOT come from?

- We do not purchase data from any other source and republish it.

- We will not purchase data from any other source and republish it

- We do not extrapolate trends, even for the forecast. We look for other market signals and leading indicators

What data should our company use?

- If you are making decisions driving significant share of profit, we always recommend that you buy data from the companies who invest in direct primary market access such as ICIS, amongst many others

- Our data, at best, represents an estimate of the market trend based on public information

- We have no direct access to the market, and we do not interview suppliers and customers

- Our automated analysis tools in the online software are set up to combine our data with other sources of data

- We do not recommend that you use our data for direct price mechanisms, as we may change and improve the data trends over time, including historical data

What does the quality indication in the main menu mean?

- Quality level A: Data is from a reliable and confirmed source

- Quality level B: Data is from multiple credible sources and there are no major statistical inconsistencies between them

- Quality level C: Data is from multiple credible sources and there are some statistical inconsistencies between them

- Quality level D: Data is from a single credible source, but we cannot verify the data

- Quality level E: Data is either:

- From a single source, which we consider reliable, but we cannot verify the data.

- From 2 or more sources which have some periods of contradicting trends.

- Quality level F: Data is from a single source which we consider indicatively correct, but the data is anecdotal and we cannot verify the data.

What are the disclaimers?

- We assume no responsibility or liability for any errors or omissions in the content of this site.

- The information is provided on an “as is” basis with no guarantee of completeness, accuracy, usefulness, fitness for purpose or timeliness.

- By their nature, outlooks are always uncertain

How often do we update the data?

- We aim to update the data series on the 9th and 24th of each month (but we do not always make it for each chart)

- The data for the current month and recent history are fine-tuned over time.

What are we doing to improve the data?

- We are continually improving our data collection and processing methods

- Pricing data will be updated from time to time as we improve the accuracy

- We are reviewing all data sources in the first half of 2024.

- There will be continuous fine-tuning of the trend and forecast algorithm as part of that.

- The key focus in 2024 is to add many additional indexes

How can i give feedback on the data or request for new indexes

- Feel free to contact us if you have a specific request. You can reach us via the Contact us page